Filed Pursuant to Rule 424(b)(2)

Registration No. 333-228720

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with and declared effective by the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell and are not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 5, 2021

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated February 5, 2019)

$

5.125% Notes due 2026

We are an externally managed specialty finance company that provides capital to lower middle market U.S. businesses (which we generally define as companies with annual earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $3 million to $15 million). We operate as a closed-end, non-diversified management investment company and have elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). For federal income tax purposes, we have elected to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Our investment objectives are to: (1) achieve and grow current income by investing in debt securities of established businesses that we believe will provide stable earnings and cash flow to pay expenses, make principal and interest payments on our outstanding indebtedness and make distributions to stockholders that grow over time; and (2) provide our stockholders with long-term capital appreciation in the value of our assets by investing in equity securities, in connection with our debt investments, that we believe can grow over time to permit us to sell our equity investments for capital gains.

We are offering $ million in aggregate principal amount of 5.125% notes due 2026 (the “Notes”). The Notes will mature on January 31, 2026. We will pay interest on the Notes on January 31 and July 31 of each year, beginning July 31, 2021. The Notes offered hereby are a further issuance of the 5.125% notes due 2026 that we issued on December 15, 2020 in the aggregate principal amount of $100.0 million (the “Existing Notes”). The Notes offered hereby will be treated as a single series with the Existing Notes under the indenture and will have the same terms as the Existing Notes. The Notes offered hereby will have the same CUSIP number and will be fungible and rank equally with the Existing Notes. Upon the issuance of the Notes offered hereby, the outstanding aggregate principal amount of our 5.125% notes due 2026 will be $ million. Unless the context otherwise requires, references herein to the “Notes” include the Notes offered hereby and the Existing Notes.

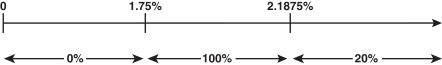

We may redeem the Notes in whole or in part at any time or from time to time, at the redemption price set forth under the section titled “Description of the Notes—Optional Redemption” in this prospectus supplement. In addition, holders of the Notes can require us to repurchase some or all of the Notes at a purchase price equal to 100% of their principal amount, plus accrued and unpaid interest to, but not including, the repurchase date, upon the occurrence of a Change of Control Repurchase Event (as defined herein). The Notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

The Notes are our direct unsecured obligations and rank equal in right of payment with all outstanding and future unsecured, unsubordinated indebtedness issued by us. Because the Notes are not secured by any of our assets, they are effectively subordinated to all of our existing and future secured indebtedness (or any indebtedness that is initially unsecured as to which we subsequently grant a security interest) to the extent of the value of the assets securing such indebtedness. The Notes are structurally subordinated to all existing and future indebtedness and other obligations of any of our subsidiaries, since the Notes are obligations exclusively of Gladstone Capital Corporation and not of any of our subsidiaries, including borrowings under our Fifth Amended and Restated Credit Agreement with KeyBank National Association, as amended (the “Credit Facility”), of which we had approximately $107.5 million outstanding as of March 3, 2021. The Notes will be senior in right of payment to any series of preferred stock we may issue in the future. None of our subsidiaries is a guarantor of the Notes and the Notes will not be required to be guaranteed by any subsidiary we may acquire or create in the future. None of our current indebtedness is subordinated to the Notes.

We do not intend to list the Notes on any securities exchange or automated dealer quotation system.

Investing in the Notes involves a high degree of risk, including the risk of leverage. Before buying any Notes, you should read the material risks described in the “Supplementary Risk Factors” section beginning on page S-11 of this prospectus supplement and “Risk Factors” beginning on page 13 of the accompanying prospectus.

THE NOTES ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF A BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

This prospectus supplement, the accompanying prospectus, any free writing prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus contain important information you should know before investing in the Notes, including information about risks. Please read these documents before you invest and retain them for future reference. Additional information about us, including our annual, quarterly and current reports, has been filed with the Securities and Exchange Commission (the “SEC”), and can be accessed free of charge at its website at www.sec.gov. This information is also available free of charge by calling us collect at (703) 287-5893 or on the Investors section of our corporate website located at www.gladstonecapital.com, which, except for the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, is not part of this prospectus supplement nor the accompanying prospectus. You may also call us collect at this number to request other information or to make a shareholder inquiry. See “Where You Can Find More Information” on page S-41 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Note | Total | |||

| Public offering price (1) |

% | $ | ||

| Underwriting discount (sales load) |

% | $ | ||

| Proceeds, before expenses, to us (2) |

% | $ |

| (1) | The public offering price set forth above does not include $ of accrued and unpaid interest from December 15, 2020 up to, but not including, the date of delivery, which will be paid by the purchasers of the Notes offered hereby. On July 31, 2021, we will pay this pre-issuance accrued interest to the holders of the Notes offered hereby as of the applicable record date along with interest accrued on the Notes offered hereby from the date of delivery to July 31, 2021. |

| (2) | Total expenses of the offering payable by us, excluding the underwriting discount, are estimated to be $ million. See “Underwriting” on page S-38 of this prospectus supplement. |

Delivery of the Notes offered hereby in book-entry form only through The Depository Trust Company (“DTC”) will be made on or about March , 2021.

Sole Book-Running Manager

Raymond James

The date of this prospectus supplement is March , 2021