The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 7, 2018

PRELIMINARY PROSPECTUS

$300,000,000

COMMON STOCK

PREFERRED STOCK

SUBSCRIPTION RIGHTS

WARRANTS

DEBT SECURITIES

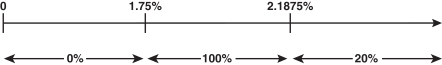

We may offer, from time to time, up to $300,000,000 aggregate initial offering price of our common stock, $0.001 par value per share, preferred stock, $0.001 par value per share, subscription rights, warrants representing rights to purchase shares of our common or preferred stock, or debt securities, or concurrent, separate offerings of these securities, (collectively “Securities”), in one or more offerings. The Securities may be offered at prices and on terms to be disclosed in one or more supplements to this prospectus. In the case of our common stock and warrants or rights to acquire such common stock hereunder, the offering price per share of our common stock by us, less any underwriting commissions or discounts, will not be less than the net asset value per share of our common stock at the time of the offering except (i) in connection with a rights offering to our existing common stockholders, (ii) with the consent of the holders of the majority of our outstanding stock, or (iii) under such other circumstances as the U.S. Securities and Exchange Commission (“SEC”) may permit. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our Securities.

We operate as an externally managed, closed-end, non-diversified management investment company and have elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). For federal income tax purposes, we have elected to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Our investment objectives are to: (1) achieve and grow current income by investing in debt securities of established businesses that we believe will provide stable earnings and cash flow to pay expenses, make principal and interest payments on our outstanding indebtedness and make distributions to stockholders that grow over time; and (2) provide our stockholders with long-term capital appreciation in the value of our assets by investing in equity securities of established businesses that we believe can grow over time to permit us to sell our equity investments for capital gains.

Our Securities may be offered directly to one or more purchasers, including existing stockholders in a rights offering, through agents designated from time to time by us, or to or through underwriters or dealers, “at-the-market” to or through a market maker into an existing trading market or otherwise directly to one or more purchasers or through agents or through a combination of methods of sale. The prospectus supplement relating to the offering will identify any agents or underwriters involved in the sale of our Securities, and will disclose any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters or among our underwriters or the basis upon which such amount may be calculated. See “Plan of Distribution.” We may not sell any of our Securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the offering of such Securities. Our common stock is traded on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “GLAD.” As of December 5, 2018, the last reported sales price for our common stock was $8.53. Our 6.00% Series 2024 Term Preferred Stock (“Series 2024 Term Preferred Stock”) is also traded on the Nasdaq under the symbol “GLADN.” As of December 5, 2018, the last reported sales price for our Series 2024 Term Preferred Stock was $25.12. Our 6.125% Notes due 2023 (“2023 Notes”) are also traded on the Nasdaq under the symbol “GLADD.” As of December 5, 2018, the last reported sales price for our 2023 Notes was $25.49.

This prospectus contains information you should know before investing in our Securities, including information about risks. Please read it before you invest and keep it for future reference. Additional information about us, including our annual, quarterly, current reports, proxy statements and other information, has been filed with the SEC and can be accessed at its website at www.sec.gov. This information is also available free of charge by writing to us at Investor Relations, Gladstone Capital Corporation, 1521 Westbranch Drive, Suite 100, McLean, VA 22102, by calling our toll-free investor relations line at 1-866-214-7543 or on our website at www.gladstonecapital.com. You may also call us collect at (703) 287-5893 to request this other information. See “Additional Information.” Information contained on our website is not incorporated by reference into this prospectus, and you should not consider that information to be part of this prospectus. This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

The securities in which we invest generally would be rated below investment grade if they were rated by rating agencies. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and are illiquid.

An investment in our Securities involves certain risks, including, among other things, risks relating to investments in securities of small, private and developing businesses. We describe some of these risks in the section entitled “Risk Factors,” which begins on page 13. Common shares of closed-end investment companies frequently trade at a discount to their net asset value and this may increase the risk of loss to purchasers of our Securities. You should carefully consider these risks together with all of the other information contained in this prospectus and any prospectus supplement before making a decision to purchase our Securities.

The SEC has not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is