UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 814-00237

GLADSTONE CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

| Maryland | 54-2040781 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1521 Westbranch Drive, Suite 100 McLean, Virginia |

22102 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 287-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value per share | NASDAQ Global Select Market | |

| 6.75% Series 2021 Term Preferred Stock, $0.001 par value per share |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12 b-2 of the Act). YES ¨ NO x.

The aggregate market value of the voting common stock held by non-affiliates of the Registrant on March 31, 2016, based on the closing price on that date of $7.45 on the NASDAQ Global Select Market, was $162,284,658. For the purposes of calculating this amount only, all directors and executive officers of the Registrant have been treated as affiliates. There were 25,517,866 shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of November 18, 2016.

Documents Incorporated by Reference. Portions of the Registrant’s definitive proxy statement filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the Registrant’s 2017 Annual Meeting of Stockholders, which will be filed subsequent to the date hereof, are incorporated by reference into Part III of this Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days following the end of the Registrant’s fiscal year ended September 30, 2016.

GLADSTONE CAPITAL CORPORATION

FORM 10-K FOR THE FISCAL YEAR ENDED

SEPTEMBER 30, 2016

| PART I |

ITEM 1 | 2 | ||||||

| ITEM 1A | 19 | |||||||

| ITEM 1B | 38 | |||||||

| ITEM 2 | 38 | |||||||

| ITEM 3 | 38 | |||||||

| ITEM 4 | 38 | |||||||

| PART II |

ITEM 5 | 39 | ||||||

| ITEM 6 | 40 | |||||||

| ITEM 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | ||||||

| ITEM 7A | 62 | |||||||

| ITEM 8 | 64 | |||||||

| ITEM 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

110 | ||||||

| ITEM 9A | 110 | |||||||

| ITEM 9B | 110 | |||||||

| PART III |

ITEM 10 | 111 | ||||||

| ITEM 11 | 111 | |||||||

| ITEM 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

111 | ||||||

| ITEM 13 | Certain Relationships and Related Transactions, and Director Independence |

111 | ||||||

| ITEM 14 | 111 | |||||||

| PART IV |

ITEM 15 | 112 | ||||||

| ITEM 16 | 114 | |||||||

| 115 |

1

FORWARD-LOOKING STATEMENTS

All statements contained herein, other than historical facts, may constitute “forward-looking statements.” These statements may relate to, among other things, our future operating results, our business prospects and the prospects of our portfolio companies, actual and potential conflicts of interest with Gladstone Management Corporation, our adviser, and its affiliates, the use of borrowed money to finance our investments, the adequacy of our financing sources and working capital, and our ability to co-invest, among other factors. In some cases, you can identify forward-looking statements by terminology such as “estimate,” “may,” “might,” “believe,” “will,” “provided,” “anticipate,” “future,” “could,” “growth,” “plan,” “intend,” “expect,” “should,” “would,” “if,” “seek,” “possible,” “potential,” “likely” or the negative of such terms or comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to: (1) the recurrence of adverse events in the economy and the capital markets; (2) risks associated with negotiation and consummation of pending and future transactions; (3) the loss of one or more of our executive officers, in particular David Gladstone, Terry Lee Brubaker or Robert L. Marcotte; (4) changes in our investment objectives and strategy; (5) availability, terms (including the possibility of interest rate volatility) and deployment of capital; (6) changes in our industry, interest rates, exchange rates or the general economy; (7) the degree and nature of our competition; (8) our ability to maintain our qualification as a RIC and as business development company; and (9) those factors described in the “Risk Factors” section of this Annual Report on Form 10-K. We caution readers not to place undue reliance on any such forward-looking statements. Actual results could differ materially from those anticipated in our forward-looking statements and future results could differ materially from historical performance. We have based forward-looking statements on information available to us on the date of this Annual Report on Form 10-K. Except as required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report on Form 10-K. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the Securities and Exchange Commission, including quarterly reports on Form 10-Q and current reports on Form 8-K.

In this Annual Report on Form 10-K, or Annual Report, the “Company,” “we,” “us,” and “our” refer to Gladstone Capital Corporation and its wholly-owned subsidiaries unless the context otherwise indicates. Dollar amounts are in thousands unless otherwise indicated.

PART I

The information contained in this section should be read in conjunction with our accompanying Consolidated Financial Statements and the notes thereto appearing elsewhere in this Annual Report on Form 10-K.

Overview

Organization

We were incorporated under the Maryland General Corporation Law on May 30, 2001, and completed our initial public offering on August 24, 2001. We operate as an externally managed, closed-end, non-diversified management investment company and have elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). For federal income tax purposes, we have elected to be treated as a regulated investment company (“RIC”) under the Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). In order to continue to qualify as a RIC for federal income tax purposes and obtain favorable RIC tax treatment, we must meet certain requirements, including certain minimum distribution requirements.

Our shares of common stock and mandatorily redeemable preferred stock are traded on the NASDAQ Global Select Market (“NASDAQ”) under the trading symbols “GLAD” and “GLADO,” respectively.

2

Investment Adviser and Administrator

We are externally managed by our affiliated investment adviser, Gladstone Management Corporation (the “Adviser”), under an investment advisory and management agreement (the “Advisory Agreement”) and another of our affiliates, Gladstone Administration, LLC, (the “Administrator” together with the Adviser and the Affiliated Public Funds (defined below), the “Gladstone Companies”)) provides administrative services to us pursuant to a contractual agreement (the “Administration Agreement”). Each of the Adviser and Administrator are privately-held companies that are indirectly owned and controlled by David Gladstone, our chairman and chief executive officer. Mr. Gladstone and Terry Brubaker, our vice chairman and chief operating officer, also serve on the board of directors of the Adviser, the board of managers of the Administrator, and serve as executive officers of the Adviser and the Administrator. The Administrator employs, among others, our chief financial officer and treasurer, chief valuation officer, chief compliance officer, general counsel and secretary (who also serves as the president of the Administrator) and their respective staffs. The Adviser and Administrator have extensive experience in our lines of business and also provide investment advisory and administrative services, respectively, to our affiliates, including, but not limited to: Gladstone Commercial Corporation (“Gladstone Commercial”), a publicly-traded real estate investment trust; Gladstone Investment Corporation (“Gladstone Investment”), a publicly-traded BDC and RIC; and Gladstone Land Corporation, a publicly-traded real estate investment trust (“Gladstone Land,” with “Gladstone Commercial,” and “Gladstone Investment,” collectively the “Affiliated Public Funds”). In the future, the Adviser and Administrator may provide investment advisory and administrative services, respectively, to other funds and companies, both public and private.

The Adviser was organized as a corporation under the laws of the State of Delaware on July 2, 2002, and is a registered investment adviser under the Investment Advisers Act of 1940, as amended. The Administrator was organized as a limited liability company under the laws of the State of Delaware on March 18, 2005. The Adviser and Administrator are headquartered in McLean, Virginia, a suburb of Washington, D.C. The Adviser also has offices in other states.

Investment Objectives and Strategy

Our investment objectives are to: (1) achieve and grow current income by investing in debt securities of established businesses that we believe will provide stable earnings and cash flow to pay expenses, make principal and interest payments on our outstanding indebtedness and make distributions to stockholders that grow over time; and (2) provide our stockholders with long-term capital appreciation in the value of our assets by investing in equity securities of established businesses that we believe can grow over time to permit us to sell our equity investments for capital gains. To achieve our objectives, our primary investment strategy is to invest in several categories of debt and equity securities, with each investment generally ranging from $8 million to $30 million, although investment size may vary, depending upon our total assets or available capital at the time of investment. We lend to borrowers that need funds for growth capital, to finance acquisitions, or to recapitalize or refinance their existing debt facilities. We seek to avoid investing in high-risk, early-stage enterprises. Our targeted portfolio companies are generally considered too small for the larger capital marketplace. We intend for our investment portfolio to consist of approximately 90.0% debt investments and 10.0% equity investments, at cost. As of September 30, 2016, our investment portfolio was made up of approximately 90.2% debt investments and 9.8% equity investments, at cost.

We invest by ourselves or jointly with other funds and/or management of the portfolio company, depending on the opportunity. If we are participating in an investment with one or more co-investors, our investment is likely to be smaller than if we were investing alone.

In July 2012, the Securities and Exchange Commission (“SEC”) granted us an exemptive order (the “Co-Investment Order) that expands our ability to co-invest with certain of our affiliates under certain circumstances and any future business development company or closed-end management investment company that is advised (or sub-advised if it controls the fund) by our external investment adviser, or any combination of the foregoing, subject to the conditions in the SEC’s order.

In general, our investments in debt securities have a term of no more than seven years, accrue interest at variable rates (based on the one month London Interbank Offered Rate (“LIBOR”)) and, to a lesser extent, at fixed rates. We seek debt instruments that pay interest monthly or, at a minimum, quarterly, and which may include a yield enhancement, such as a success fee or deferred interest provision and are primarily interest only with all principal and any accrued but unpaid interest due at maturity. Generally, success fees accrue at a set rate and are contractually due upon a change of control of the business. Some debt securities have deferred interest whereby some portion of the interest payment is added to the principal balance so that the interest is paid, together with the principal, at maturity. This form of deferred interest is often called paid-in-kind (“PIK”) interest. Typically, our equity investments take the form of preferred or common stock, limited liability company interests, or warrants or options to purchase the foregoing. Often, these equity investments occur in connection with our original investment, recapitalizing a business, or refinancing existing debt.

3

As of September 30, 2016, our investment portfolio consisted of investments in 45 companies located in 22 states in 20 different industries with an aggregate fair value of $322.1 million. Since our initial public offering in 2001 through September 30, 2016, we have invested in over 206 different companies, while making 164 consecutive monthly or quarterly cash distributions to common stockholders totaling approximately $276.3 million or $16.06 per share. We expect that our investment portfolio will primarily include the following four categories of investments in private companies operating in the United States (“U.S.”):

| • | Senior Secured Debt Securities: We seek to invest a portion of our assets in senior secured debt securities also known as senior loans, secured first lien loans, lines of credit and senior notes. Using its assets as collateral, the borrower typically uses senior debt to cover a substantial portion of the funding needs of its business. The senior secured debt security usually takes the form of first priority liens on all, or substantially all, of the assets of the business. Senior secured debt securities may include investments sourced from the syndicated loan market. |

| • | Senior Secured Subordinated Debt Securities: We seek to invest a portion of our assets in secured second lien debt securities, also known as senior subordinated loans and senior subordinated notes. These secured second lien debts rank junior to the borrowers’ senior debt and may be secured by a first priority lien on a portion of the assets of the business and may be designated as second lien notes (including our participation and investment in syndicated second lien loans). Additionally, we may receive other yield enhancements, such as success fees, in connection with these senior secured subordinated debt securities. |

| • | Junior Subordinated Debt Securities: We seek to invest a portion of our assets in junior subordinated debt securities, also known as subordinated loans, subordinated notes and mezzanine loans. These junior subordinated debts may be secured by certain assets of the borrower or unsecured loans. Additionally, we may receive other yield enhancements in addition to or in lieu of success fees, such as warrants to buy common and preferred stock or limited liability interests in connection with these junior subordinated debt securities. |

| • | Preferred and Common Equity/Equivalents: In some cases we will purchase equity securities which consist of preferred and common equity or limited liability company interests, or warrants or options to acquire such securities, and are in combination with our debt investment in a business. Additionally, we may receive equity investments derived from restructurings on some of our existing debt investments. In some cases, we will own a significant portion of the equity and in other cases we may have voting control of the businesses in which we invest. |

Additionally, pursuant to the 1940 Act, we must maintain at least 70.0% of our total assets in qualifying assets, which generally include each of the investment types listed above. Therefore, the 1940 Act permits us to invest up to 30.0% of our assets in other non-qualifying assets. See “Regulation as a BDC — Qualifying Assets” for a discussion of the types of qualifying assets in which we are permitted to invest pursuant to Section 55(a) of the 1940 Act.

Because the majority of the loans in our portfolio consist of term debt in private companies that typically cannot or will not expend the resources to have their debt securities rated by a credit rating agency, we expect that most, if not all, of the debt securities we acquire will be unrated. Investors should assume that these loans would be rated below what is today considered “investment grade” quality. Investments rated below investment grade are often referred to as high yield securities or junk bonds and may be considered higher risk, as compared to investment-grade debt instruments. In addition, many of the debt securities we hold typically do not amortize prior to maturity.

Investment Policies

We seek to achieve a high level of current income and capital gains through investments in debt securities and preferred and common stock that we generally acquire in connection with buyouts and other recapitalizations. The following investment policies, along with these investment objectives, may not be changed without the approval of our board of directors (“Board of Directors”):

4

| • | We will at all times conduct our business so as to retain our status as a BDC. In order to retain that status, we must operate for the purpose of investing in certain categories of qualifying assets. In addition, we may not acquire any assets (other than non-investment assets necessary and appropriate to our operations as a BDC or qualifying assets) if, after giving effect to such acquisition, the value of our “qualifying assets” is less than 70.0% of the value of our total assets. We anticipate that the securities we seek to acquire will generally be qualifying assets. |

| • | We will at all times endeavor to conduct our business so as to retain our status as a RIC under the Code. To do so, we must meet income source, asset diversification and annual distribution requirements. We may issue senior securities, such as debt or preferred stock, to the extent permitted by the 1940 Act for the purpose of making investments, to fund share repurchases, or for temporary emergency or other purposes. |

With the exception of our policy to conduct our business as a BDC, these policies are not fundamental and may be changed without stockholder approval.

Investment Concentrations

Year over year, our investment concentration as a percentage of fair value and of cost has remained relatively unchanged. As of September 30, 2016, our portfolio allocation is approximately 90.2% debt investments and 9.8% equity investments, at cost. Our portfolio consists primarily of proprietary investments, however, we continue to invest in syndicated investments where we participate with a group of other lenders. As of September 30, 2016, we held 13 syndicated investments totaling $38.9 million at cost and $30.8 million at fair value, or 10.2% and 9.6% of our total aggregate portfolio at cost and at fair value, respectively. We held 15 syndicated investments totaling $61.4 million at cost and $55.0 million at fair value, or 15.0% of our total aggregate portfolio at cost and at fair value, respectively, as of September 30, 2015.

The following table outlines our investments by security type at September 30, 2016 and 2015:

| September 30, 2016 | September 30, 2015 | |||||||||||||||||||||||||||||||

| Cost | Fair Value | Cost | Fair Value | |||||||||||||||||||||||||||||

| Secured first lien debt |

$ | 227,439 | 59.6 | % | $ | 198,721 | 61.7 | % | $ | 248,050 | 60.5 | % | $ | 206,840 | 56.5 | % | ||||||||||||||||

| Secured second lien debt |

113,796 | 29.8 | 100,320 | 31.2 | 125,875 | 30.7 | 120,303 | 32.9 | ||||||||||||||||||||||||

| Unsecured debt |

2,995 | 0.8 | 3,012 | 0.9 | — | — | — | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total debt investments |

344,230 | 90.2 | 302,053 | 93.8 | 373,925 | 91.2 | 327,143 | 89.4 | ||||||||||||||||||||||||

| Preferred equity |

22,988 | 6.0 | 10,262 | 3.2 | 22,616 | 5.5 | 22,262 | 6.1 | ||||||||||||||||||||||||

| Common equity/equivalents |

14,583 | 3.8 | 9,799 | 3.0 | 13,703 | 3.3 | 16,486 | 4.5 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total equity investments |

37,571 | 9.8 | 20,061 | 6.2 | 36,319 | 8.8 | 38,748 | 10.6 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Investments |

$ | 381,801 | 100.0 | % | $ | 322,114 | 100.0 | % | $ | 410,244 | 100.0 | % | $ | 365,891 | 100.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Our five largest investments at fair value as of September 30, 2016, totaled $112.1 million, or 34.8% of our total aggregate portfolio, as compared to our five largest investments at fair value as of September 30, 2015, totaling $109.6 million, or 30.0% of our total aggregate portfolio.

5

Our investments at fair value consisted of the following industry classifications at September 30, 2016 and 2015:

| September 30, 2016 | September 30, 2015 | |||||||||||||||

| Industry Classification |

Fair Value | Percentage of Total Investments |

Fair Value | Percentage of Total Investments |

||||||||||||

| Healthcare, education and childcare |

$ | 70,577 | 21.9 | % | $ | 44,994 | 12.3 | % | ||||||||

| Diversified/Conglomerate Manufacturing |

50,106 | 15.6 | 56,504 | 15.4 | ||||||||||||

| Diversified/Conglomerate Service |

48,898 | 15.2 | 13,763 | 3.8 | ||||||||||||

| Oil and gas |

31,279 | 9.7 | 51,110 | 14.0 | ||||||||||||

| Beverage, food and tobacco |

15,022 | 4.7 | 22,817 | 6.2 | ||||||||||||

| Automobile |

14,837 | 4.6 | 17,699 | 4.8 | ||||||||||||

| Diversified natural resources, precious metals and minerals |

14,821 | 4.6 | 16,072 | 4.4 | ||||||||||||

| Cargo Transportation |

13,000 | 4.0 | 13,434 | 3.7 | ||||||||||||

| Buildings and real estate |

11,223 | 3.5 | 2,385 | 0.7 | ||||||||||||

| Leisure, Amusement, Motion Pictures, Entertainment |

8,769 | 2.7 | 8,500 | 2.3 | ||||||||||||

| Personal and non-durable consumer products |

7,858 | 2.4 | 43,418 | 11.9 | ||||||||||||

| Printing and publishing |

6,033 | 1.9 | 25,452 | 7.0 | ||||||||||||

| Telecommunications |

5,790 | 1.8 | 5,865 | 1.6 | ||||||||||||

| Machinery |

5,597 | 1.7 | 4,655 | 1.3 | ||||||||||||

| Broadcast and entertainment |

4,682 | 1.5 | 5,235 | 1.4 | ||||||||||||

| Textiles and leather |

3,836 | 1.2 | 6,911 | 1.9 | ||||||||||||

| Finance |

3,000 | 0.9 | 8,356 | 2.3 | ||||||||||||

| Electronics |

2,980 | 0.9 | 13,550 | 3.7 | ||||||||||||

| Other, < 2.0% |

3,806 | 1.2 | 5,171 | 1.3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 322,114 | 100.0 | % | $ | 365,891 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Our investments at fair value were included in the following U.S. geographic regions at September 30, 2016 and 2015:

| September 30, 2016 | September 30, 2015 | |||||||||||||||

| Geographic Region |

Fair Value | Percentage of Total Investments |

Fair Value | Percentage of Total Investments |

||||||||||||

| South |

$ | 131,181 | 40.8 | % | $ | 117,367 | 32.1 | % | ||||||||

| Midwest |

100,142 | 31.1 | 124,924 | 34.1 | ||||||||||||

| West |

57,786 | 17.9 | 112,575 | 30.8 | ||||||||||||

| Northeast |

33,005 | 10.2 | 11,025 | 3.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 322,114 | 100.0 | % | $ | 365,891 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The geographic region indicates the location of the headquarters for our portfolio companies. A portfolio company may have a number of other business locations in other geographic regions.

Investment Process

Overview of Investment and Approval Process

To originate investments, the Adviser’s investment professionals use an extensive referral network comprised primarily of private equity sponsors, leveraged buyout funds, investment bankers, attorneys, accountants, commercial bankers and business brokers. The Adviser’s investment professionals review information received from these and other sources in search of potential financing opportunities. If a potential opportunity matches our investment objectives, the investment professionals will seek an initial screening of the opportunity with our president, Robert L. Marcotte, to authorize the submission of an indication of interest (“IOI”) to the prospective portfolio company. If the prospective portfolio company passes this initial screening and the IOI is accepted by the prospective company, the investment professionals will seek approval to issue a letter of intent (“LOI”) from the Adviser’s investment committee, which is composed of Messers. Gladstone, Brubaker and Marcotte, to the prospective company. If this LOI is issued, then the Adviser and Gladstone Securities (the “Due Diligence Team”) will conduct a due diligence investigation and create a detailed profile summarizing the prospective portfolio company’s historical financial statements, industry, competitive position and management team and analyzing its conformity to our general investment criteria. The investment professionals then present this profile to the Adviser’s investment committee, which must approve each investment. Further, each investment is available for review by the members of our Board of Directors, a majority of whom are not “interested persons”, as defined in Section 2(a)(19) of the 1940 Act.

6

Prospective Portfolio Company Characteristics

We have identified certain characteristics that we believe are important in identifying and investing in prospective portfolio companies. The criteria listed below provide general guidelines for our investment decisions, although not all of these criteria may be met by each portfolio company.

| • | Value-and-Income Orientation and Positive Cash Flow. Our investment philosophy places a premium on fundamental analysis from an investor’s perspective and has a distinct value-and-income orientation. In seeking value, we focus on established companies in which we can invest at relatively low multiples of earnings before interest, taxes, depreciation and amortization (“EBITDA”), and that have positive operating cash flow at the time of investment. In seeking income, we typically invest in companies that generate relatively stable to growing sales and cash flow to provide some assurance that they will be able to service their debt. We do not expect to invest in start-up companies or companies with what we believe to be speculative business plans. |

| • | Experienced Management. We typically require that the businesses in which we invest have experienced management teams. We also require the businesses to have in place proper incentives to induce management to succeed and act in concert with our interests as investors, including having significant equity or other interests in the financial performance of their companies. |

| • | Strong Competitive Position in an Industry. We seek to invest in businesses that have developed strong market positions within their respective markets and that we believe are well-positioned to capitalize on growth opportunities. We seek businesses that demonstrate significant competitive advantages versus their competitors, which we believe will help to protect their market positions and profitability. |

| • | Enterprise Collateral Value. The projected enterprise valuation of the business, based on market based comparable cash flow multiples, is an important factor in our investment analysis in determining the collateral coverage of our debt securities. |

Extensive Due Diligence

The Due Diligence Team conducts what we believe are extensive due diligence investigations of our prospective portfolio companies and investment opportunities. The due diligence investigation may begin with a review of publicly available information followed by in depth business analysis, including, but not limited to, some or all of the following:

| • | a review of the prospective portfolio company’s historical and projected financial information, including a quality of earnings analysis; |

| • | visits to the prospective portfolio company’s business site(s); |

| • | interviews with the prospective portfolio company’s management, employees, customers and vendors; |

| • | review of loan documents and material contracts; |

| • | background checks and a management capabilities assessment on the prospective portfolio company’s management team; and |

| • | research on the prospective portfolio company’s products, services or particular industry and its competitive position therein. |

Upon completion of a due diligence investigation and a decision to proceed with an investment, the Adviser’s investment professionals who have primary responsibility for the investment present the investment opportunity to the Adviser’s investment committee. The investment committee then determines whether to pursue the potential investment. Additional due diligence of a potential investment may be conducted on our behalf by attorneys and independent accountants, as well as other outside advisers, prior to the closing of the investment, as appropriate.

7

We also rely on the long-term relationships that the Adviser’s investment professionals have with leveraged buyout funds, investment bankers, commercial bankers, private equity sponsors, attorneys, accountants, and business brokers. In addition, the extensive direct experiences of our executive officers and managing directors in the operations of and providing debt and equity capital to lower middle market companies plays a significant role in our investment evaluation and assessment of risk.

Investment Structure

Once the Adviser has determined that an investment meets our standards and investment criteria, the Adviser works with the management of that company and other capital providers to structure the transaction in a way that we believe will provide us with the greatest opportunity to maximize our return on the investment, while providing appropriate incentives to management of the company. As discussed above, the capital classes through which we typically structure a deal include senior debt, senior subordinated debt, junior subordinated debt, and preferred and common equity or equivalents. Through its risk management process, the Adviser seeks to limit the downside risk of our investments by:

| • | seeking collateral or superior positions in the portfolio company’s capital structure where possible; |

| • | negotiating covenants in connection with our investments that afford our portfolio companies as much flexibility as possible in managing their businesses, consistent with preserving our capital; |

| • | holding board seats or securing board observation rights at the portfolio company; |

| • | incorporating put rights and call protection into the investment structure where possible; and |

| • | making investments with an expected total return (including both interest and potential equity appreciation) that it believes compensates us for the credit risk of the investment. |

We expect to hold most of our debt investments until maturity or repayment, but may sell our investments (including our equity investments) earlier if a liquidity event takes place, such as the sale or recapitalization of a portfolio company. Occasionally, we may sell some or all of our investment interests in a portfolio company to a third party in a privately negotiated transaction to manage our credit or sector exposures or to enhance our portfolio yield.

Competitive Advantages

A large number of entities compete with us and make the types of investments that we seek to make in lower middle market privately-owned businesses. Such competitors include BDCs, non-equity based investment funds, and other financing sources, including traditional financial services companies such as commercial banks. Many of our competitors are substantially larger than we are and have considerably greater funding sources or are able to access capital more cost effectively. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments, serve a broader customer base and establish a greater market share. Furthermore, many of these competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC. However, we believe that we have the following competitive advantages over other providers of financing to lower middle market companies.

Management Expertise

Our Adviser has a separate investment committee for the Company and each of the Affiliated Public Funds. The Adviser’s investment committee for the Company is comprised of Messrs. Gladstone, Brubaker and Marcotte, each of whom have a wealth of experience in our area of operation. Mr. Gladstone and Mr. Brubaker also serve on the Adviser’s investment committee for the other Affiliated Public Funds. Mr. Gladstone has been the chairman and chief executive officer of each of the Gladstone Companies since their founding. Mr. Gladstone and Mr. Marcotte both have over twenty-five years of experience in investing in middle market companies and with operating in the BDC marketplace in general. Mr. Brubaker has over twenty-five years of experience in acquisitions and operations of companies. Messrs. Gladstone and Brubaker also have principal management responsibility for the Adviser as its executive officers. These three individuals dedicate a significant portion of their time to managing our investment portfolio. Our senior management has extensive experience providing capital to lower middle market companies and Messrs. Gladstone and Brubaker have worked together at the Gladstone Companies for more than ten years. In addition, we have access to the resources and expertise of the Adviser’s investment professionals and support staff who possess a broad range of transactional, financial, managerial and investment skills.

8

Increased Access to Investment Opportunities Developed Through Extensive Research Capability and Network of Contacts

The Adviser seeks to identify potential investments through active origination and due diligence and through its dialogue with numerous management teams, members of the financial community and potential corporate partners with whom the Adviser’s investment professionals have long-term relationships. We believe that the Adviser’s investment professionals have developed a broad network of contacts within the investment, commercial banking, private equity and investment management communities, and that their reputation, experience and focus on investing in lower middle market companies enables us to source and identify well-positioned prospective portfolio companies, that provide attractive investment opportunities. Additionally, the Adviser expects to generate information from its professionals’ network of accountants, consultants, lawyers and management teams of portfolio companies and other contacts to support the Adviser’s investment activities.

Disciplined, Value and Income-Oriented Investment Philosophy with a Focus on Preservation of Capital

In making its investment decisions, the Adviser focuses on the risk and reward profile of each prospective portfolio company, seeking to minimize the risk of capital loss without foregoing the potential for capital appreciation. We expect the Adviser to use the same value and income-oriented investment philosophy that its professionals use in the management of the other Gladstone Companies and to commit resources to manage downside exposure. The Adviser’s approach seeks to reduce our risk in investments by using some or all of the following approaches:

| • | focusing on companies with sustainable market positions and cash flow; |

| • | investing in businesses with experienced and established management teams; |

| • | engaging in extensive due diligence from the perspective of a long-term investor; |

| • | investing at low price-to-cash flow multiples; and |

| • | adopting flexible transaction structures by drawing on the experience of the investment professionals of the Adviser and its affiliates. |

Longer Investment Horizon

Unlike private equity funds that are typically organized as finite-life partnerships, we are not subject to standard periodic capital return requirements. The partnership agreements of most private equity funds typically provide that these funds may only invest investors’ capital once and must return all capital and realized gains to investors within a finite time period, often seven to ten years. These provisions often force private equity funds to seek returns on their investments by causing their portfolio companies to pursue mergers, public equity offerings, or other liquidity events more quickly than might otherwise be optimal or desirable, potentially resulting in a lower overall return to investors and/or an adverse impact on their portfolio companies. In contrast, we are an exchange-traded corporation of perpetual duration. We believe that our flexibility to make investments with a long-term view and without the capital return requirements of traditional private investment vehicles provides us with the opportunity to achieve greater long-term returns on invested capital.

Flexible Transaction Structuring

We believe our management team’s broad expertise and its ability to draw upon many years of combined experience enables the Adviser to identify, assess, and structure investments successfully across all levels of a company’s capital structure and manage potential risk and return at all stages of the economic cycle. We are not subject to many of the regulatory limitations that govern traditional lending institutions, such as banks. As a result, we are flexible in selecting and structuring investments, adjusting investment criteria and transaction structures and, in some cases, the types of securities in which we invest. We believe that this approach enables the Adviser to craft a financing structure which best fits the investment and growth profile of the underlying business and yields attractive investment opportunities that will continue to generate current income and capital gain potential throughout the economic cycle, including during turbulent periods in the capital markets.

9

Ongoing Management of Investments and Portfolio Company Relationships

The Adviser’s investment professionals actively oversee each investment by continuously evaluating the portfolio company’s performance and typically working collaboratively with the portfolio company’s management to identify and incorporate best resources and practices that help us achieve our projected investment performance.

Monitoring

The Adviser’s investment professionals monitor the financial performance, trends, and changing risks of each portfolio company on an ongoing basis to determine if each company is performing within expectations and to guide the portfolio company’s management in taking the appropriate courses of action. The Adviser employs various methods of evaluating and monitoring the performance of our investments in portfolio companies, which can include the following:

| • | monthly analysis of financial and operating performance; |

| • | assessment of the portfolio company’s performance against its business plan and our investment expectations; |

| • | attendance at and/or participation in the portfolio company’s board of directors or management meetings; |

| • | assessment of portfolio company management, sponsor, governance and strategic direction; |

| • | assessment of the portfolio company’s industry and competitive environment; and |

| • | review and assessment of the portfolio company’s operating outlook and financial projections. |

Relationship Management

The Adviser’s investment professionals interact with various parties involved with a portfolio company, or investment, by actively engaging with internal and external constituents, including:

| • | management; |

| • | boards of directors; |

| • | financial sponsors; |

| • | capital partners; and |

| • | advisers and consultants. |

Managerial Assistance and Services

As a BDC, we make available significant managerial assistance, as defined in the 1940 Act, to our portfolio companies and provide other services (other than such managerial assistance) to such portfolio companies. Neither we, nor the Adviser, currently receive fees in connection with the managerial assistance we make available. At times, the Adviser may also provide other services to our portfolio companies under certain agreements and may receive fees for services other than managerial assistance. Such services may include, but are not limited to: (i) assistance obtaining, sourcing or structuring credit facilities, long term loans or additional equity from unaffiliated third parties; (ii) negotiating important contractual financial relationships; (iii) consulting services regarding restructuring of the portfolio company and financial modeling as it relates to raising additional debt and equity capital from unaffiliated third parties; and (iv) taking a primary role in interviewing, vetting and negotiating employment contracts with candidates in connection with adding and retaining key portfolio company management team members. The Adviser voluntarily, unconditionally, and irrevocably credits 100% of these fees against the base management fee that we would otherwise be required to pay to the Adviser as discussed below in “—Transactions with Related Parties – Investment Advisory and Management Agreement – Base Management Fee;” however, pursuant to the terms of the Advisory Agreement, a small percentage of certain of such fees is retained by the Adviser in the form of reimbursement, at cost, for tasks completed by personnel of the Adviser, primarily for the valuation of portfolio companies.

10

In February 2011, Gladstone Securities started providing other services (such as investment banking and due diligence services) to certain of our portfolio companies; see “—Transactions with Related Parties – Other Transactions” below.

Valuation Process

The following is a general description of the investment valuation policy (the “Policy”) (which has been approved by our Board of Directors) that the professionals of the Adviser and Administrator, with oversight and direction from our chief valuation officer, an employee of the Administrator who reports directly to our Board of Directors, (collectively, the “Valuation Team”) use each quarter to determine the value of our investment portfolio. In accordance with the 1940 Act, our Board of Directors has the ultimate responsibility for reviewing and approving, in good faith, the fair value of our investments based on the Policy. The Valuation Team values our investments in accordance with the requirements of the 1940 Act and accounting principles generally accepted in the U.S. (“GAAP”). Fair value (especially for investments in privately-held businesses) depends upon the specific facts and circumstances of each individual investment. Each quarter, our Board of Directors, including the Valuation Committee of our Board of Directors (the “Valuation Committee”), which is comprised entirely of independent directors, reviews the Policy to determine if changes thereto are advisable and assesses whether the Valuation Team has applied the Policy consistently. With respect to the valuation of our investment portfolio, the Valuation Team performs the following steps each quarter:

| • | Each investment is initially assessed by the Valuation Team using the Policy, which may include: |

| • | obtaining fair value quotes or utilizing input from third party valuation firms; and |

| • | using techniques, such as total enterprise value, yield analysis, market quotes and other factors, including but not limited to: the nature and realizable value of the collateral, including external parties’ guaranties; any relevant offers or letters of intent to acquire the portfolio company; and the markets in which the portfolio company operates. |

| • | Preliminary valuation conclusions are then discussed amongst the Valuation Team and with our management and documented for review by the Valuation Committee and Board of Directors. Written valuation recommendations and supporting material are sent to the Board of Directors in advance of the quarterly meetings. |

| • | Next, the Valuation Committee meets to review this documentation and discuss the information provided by our Valuation Team, and determines whether the Valuation Team has followed the Policy, determines whether the Valuation Team’s recommended fair value is reasonable in light of the Policy and reviews other facts and circumstances. Then, the Valuation Committee and chief valuation officer present the Valuation Committee’s findings to the entire Board of Directors, so that the full Board of Directors may review and approve, with a vote, to accept or reject the fair value recommendations in accordance with the Policy. |

Fair value measurements of our investments may involve subjective judgment and estimates. Due to the inherent uncertainty of determining these fair values, the fair value of our investments may fluctuate, from period to period. Our valuation policies, procedures and processes are more fully described in Note 2—Summary of Significant Accounting Policies in the notes to our accompanying Consolidated Financial Statements included elsewhere in this report.

Transactions with Related Parties

Investment Advisory and Management Agreement

In 2006, we entered into the Advisory Agreement, which was subsequently amended in October 2015, as approved unanimously by our Board of Directors, including the unanimous approval of our independent directors, to reduce the base management fee payable to the Adviser effective July 1, 2015, as discussed further below. In accordance with the Advisory Agreement, we pay the Adviser fees as compensation for its services, consisting of a base management fee and an incentive fee. On July 12, 2016, our Board of Directors, including a majority of the directors who are not parties to the agreement or interested person of any such party, unanimously approved the annual renewal of the Advisory Agreement with the Adviser through August 31, 2017. Mr. Gladstone, our chairman and chief executive officer, controls the Adviser. The Board of Directors considered the following factors as the basis for its decision to renew the Advisory Agreement: (1) the nature, extent and quality of services provided by the Adviser to our shareholders; (2) the investment performance of the Company and the Adviser; (3) the costs of the services to be provided and profits to be realized by the Adviser and its affiliates from the relationship with the Company; (4) the extent to which economies of scale will be realized as the Company and the

11

Affiliated Public Funds grow and whether the fee level under the Advisory Agreement reflects the economies of scale for the Company’s investors; (5) the fee structure of the advisory and administrative agreements of comparable funds; (6) indirect profits to the Adviser created through the Company; and (7) in light of the foregoing considerations, the overall fairness of the advisory fee paid under the Advisory Agreement.

Based on the information reviewed and the considerations detailed above, our Board of Directors, including all of the directors who are not “interested persons” as that term is defined in the 1940 Act, concluded that the investment advisory fee rates and terms are fair and reasonable in relation to the services provided and approved the Advisory Agreement, as being in the best interests of our stockholders.

Base Management Fee

The base management fee is computed and payable quarterly to the Adviser and, effective July 1, 2015, is assessed at an annual rate of 1.75%, computed on the basis of the value of our average gross assets at the end of the two most recently completed quarters (inclusive of the current quarter), which are total assets, including investments made with proceeds of borrowings, less any uninvested cash or cash equivalents resulting from borrowings, and adjusted appropriately for any share issuances or repurchases during the period. Prior to July 1, 2015, the annual rate was 2.0%. Our Board of Directors may (as it has for the years ended September 30, 2016, 2015 and 2014) accept an unconditional and irrevocable credit from the Adviser to reduce the annual 1.75% (or prior to July 1, 2015, 2.0%) base management fee on senior syndicated loan participations to 0.5%, to the extent that proceeds resulting from borrowings were used to purchase such senior syndicated loan participations.

Additionally, as stated above, pursuant to the requirements of the 1940 Act, the Adviser makes available significant managerial assistance to our portfolio companies. The Adviser may also provide other services to our portfolio companies under certain agreements and may receive fees for services other than managerial assistance. The Adviser voluntarily, unconditionally, and irrevocably credits 100% of these fees against the base management fee that we would otherwise be required to pay to the Adviser; however, pursuant to the terms of the Advisory Agreement, a small percentage of certain of such fees is retained by the Adviser in the form of reimbursement, at cost, for tasks completed by personnel of the Adviser, primarily for the valuation of portfolio companies. Loan servicing fees that are payable to the Adviser pursuant to our Fifth Amended and Restated Credit Agreement, with KeyBank National Association (“KeyBank”), as administrative agent, lead arranger and a lender, as amended (our “Credit Facility”), are also 100% credited against the base management fee as discussed below “—Loan Servicing Fee Pursuant to Credit Agreement”).

Incentive Fee

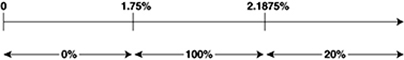

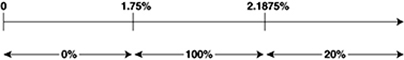

The incentive fee consists of two parts: an income-based incentive fee and a capital gains-based incentive fee. The income-based incentive fee rewards the Adviser if our quarterly net investment income (before giving effect to any incentive fee) exceeds 1.75% of our net assets, adjusted appropriately for any share issuances or repurchases during the period (the “hurdle rate”). The income-based incentive fee with respect to our pre-incentive fee net investment income is generally payable quarterly to the Adviser and is computed as follows:

| • | no incentive fee in any calendar quarter in which our pre-incentive fee net investment income does not exceed the hurdle rate (7.0% annualized); |

| • | 100.0% of our pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 2.1875% in any calendar quarter (8.75% annualized); and |

| • | 20.0% of the amount of our pre-incentive fee net investment income, if any, that exceeds 2.1875% in any calendar quarter (8.75% annualized). |

12

Quarterly Incentive Fee Based on Net Investment Income

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income

allocated to income-related portion of incentive fee

The second part of the incentive fee is a capital gains-based incentive fee that is determined and payable in arrears as of the end of each fiscal year (or upon termination of the Advisory Agreement, as of the termination date), and equals 20.0% of our realized capital gains, less any realized capital losses and unrealized depreciation, calculated as of the end of the preceding fiscal year. The capital gains-based incentive fee payable to the Adviser is calculated based on (i) cumulative aggregate realized capital gains since our inception, less (ii) cumulative aggregate realized capital losses since our inception, less (iii) the entire portfolio’s aggregate unrealized capital depreciation, if any, as of the date of the calculation. If this number is positive at the applicable calculation date, then the capital gains-based incentive fee for such year equals 20.0% of such amount, less the aggregate amount of any capital gains-based incentive fees paid in respect of our portfolio in all prior years. For calculation purposes, cumulative aggregate realized capital gains, if any, equals the sum of the excess between the net sales price of each investment, when sold, and the original cost of such investment since our inception. Cumulative aggregate realized capital losses equals the sum of the deficit between the net sales price of each investment, when sold, and the original cost of such investment since our inception. The entire portfolio’s aggregate unrealized capital depreciation, if any, equals the sum of the deficit between the fair value of each investment security as of the applicable calculation date and the original cost of such investment security. We have not incurred capital gains-based incentive fees from inception through September 30, 2016, as cumulative net unrealized capital depreciation has exceeded cumulative realized capital gains net of cumulative realized capital losses.

Additionally, in accordance with GAAP, a capital gains-based incentive fee accrual is calculated using the aggregate cumulative realized capital gains and losses and aggregate cumulative unrealized capital depreciation included in the calculation of the capital gains-based incentive fee plus the aggregate cumulative unrealized capital appreciation. If such amount is positive at the end of a period, then GAAP requires us to record a capital gains-based incentive fee equal to 20.0% of such amount, less the aggregate amount of actual capital gains-based incentive fees paid in all prior years. If such amount is negative, then there is no accrual for such year. GAAP requires that the capital gains-based incentive fee accrual consider the cumulative aggregate unrealized capital appreciation in the calculation, as a capital gains-based incentive fee would be payable if such unrealized capital appreciation were realized. There can be no assurance that any such unrealized capital appreciation will be realized in the future. There has been no GAAP accrual recorded for a capital gains-based incentive fee since our inception through September 30, 2016.

Our Board of Directors accepted an unconditional and irrevocable credit from the Adviser to reduce the income-based incentive fee to the extent net investment income did not cover 100.0% of the distributions to common stockholders for the years ended September 30, 2016, 2015 and 2014, which credits totaled $1.4 million, $1.4 million, and $1.2 million, respectively.

Loan Servicing Fee Pursuant to Credit Agreement

The Adviser also services the loans held by Gladstone Business Loan, LLC (“Business Loan”) (the borrower under our line of credit), in return for which the Adviser receives a 1.5% annual fee payable monthly based on the monthly aggregate outstanding balance of loans pledged under our line of credit. Since Business Loan is a consolidated subsidiary of ours, and the total base management fee paid to the Adviser pursuant to the Advisory Agreement cannot exceed 1.75% of total assets (as reduced by cash and cash equivalents pledged to creditors) during any given calendar year, we treat payment of the loan servicing fee pursuant to our line of credit as a pre-payment of the base management fee under the Advisory Agreement. Accordingly, for the years ended September 30, 2016, 2015 and 2014, these loan servicing fees were 100% voluntarily, irrevocably and unconditionally credited back to us by the Adviser.

13

Administration Agreement

In 2006, we entered into the Administration Agreement, whereby we pay separately for administrative services. The Administration Agreement provides for payments equal to our allocable portion of the Administrator’s expenses incurred while performing services to us, which are primarily rent and salaries and benefits expenses of the Administrator’s employees, including our chief financial officer and treasurer, chief compliance officer, chief valuation officer and general counsel and secretary (who also serves as the Administrator’s president). Prior to July 1, 2014, our allocable portion of the expenses were derived by multiplying that portion of the Administrator’s expenses allocable to all funds managed by the Adviser by the percentage of our total assets at the beginning of each quarter in comparison to the total assets at the beginning of each quarter of all funds managed by the Adviser.

Effective July 1, 2014, our allocable portion of the Administrator’s expenses are generally derived by multiplying the Administrator’s total expenses by the approximate percentage of time during the current quarter the Administrator’s employees performed services for us in relation to their time spent performing services for all companies serviced by the Administrator under contractual agreements. These administrative fees are accrued at the end of the quarter when the services are performed and generally paid the following quarter. On July 12, 2016, our Board of Directors approved the annual renewal of the Administration Agreement through August 31, 2017.

Other Transactions

Mr. Gladstone also serves on the board of managers of our affiliate, Gladstone Securities, LLC (“Gladstone Securities”), a privately-held broker-dealer registered with the Financial Industry Regulatory Authority (“FINRA”) and insured by the Securities Investor Protection Corporation. Gladstone Securities is 100% indirectly owned and controlled by Mr. Gladstone and has provided other services, such as investment banking and due diligence services, to certain of our portfolio companies, for which Gladstone Securities receives a fee. Any such fees paid by portfolio companies to Gladstone Securities do not impact the fees we pay to the Adviser or the voluntary, unconditional, and irrevocable credits against the base management fee or incentive fee. For additional information refer to Note 4 — Related Party Transactions of the notes to our accompanying Consolidated Financial Statements.

Material U.S. Federal Income Tax Considerations

Regulated Investment Company Status

To maintain the qualification for treatment as a RIC under Subchapter M of the Code, we must generally distribute to our stockholders, for each taxable year, at least 90.0% of our investment company taxable income, which is our ordinary income plus the excess of our net short-term capital gains over net long-term capital losses. We refer to this as the “annual distribution requirement”. We must also meet several additional requirements, including:

| • | Business Development Company status. At all times during the taxable year, we must maintain our status as a BDC. |

| • | Income source requirements. At least 90.0% of our gross income for each taxable year must be from dividends, interest, payments with respect to securities, loans, gains from sales or other dispositions of securities or other income derived with respect to our business of investing in securities, and net income derived from an interest in a qualified publicly traded partnership. |

| • | Asset diversification requirements. As of the close of each quarter of our taxable year: (1) at least 50.0% of the value of our assets must consist of cash, cash items, U.S. government securities, the securities of other regulated investment companies and other securities to the extent that (a) we do not hold more than 10.0% of the outstanding voting securities of an issuer of such other securities, and (b) such other securities of any one issuer do not represent more than 5.0% of our total assets; and (2) no more than 25.0% of the value of our total assets may be invested in the securities of one issuer (other than U.S. government securities or the securities of other regulated investment companies), or of two or more issuers that are controlled by us and are engaged in the same or similar or related trades or businesses or in the securities of one or more qualified publicly traded partnerships. |

14

Failure to Qualify as a RIC

If we are unable to qualify for treatment as a RIC, we will be subject to tax on all of our taxable income at regular corporate rates. We would not be able to deduct distributions to stockholders, nor would we be required to make such distributions. Distributions would be taxable to our stockholders as dividend income to the extent of our current and accumulated earnings and profits. Subject to certain limitations under the Code, corporate distributees would be eligible for the dividends received deduction. Distributions in excess of our current and accumulated earnings and profits would be treated first as a return of capital to the extent of the stockholder’s adjusted tax basis, and then as a gain realized from the sale or exchange of property. If we fail to meet the RIC requirements for more than two consecutive years and then seek to requalify as a RIC, we generally would be subject to corporate-level federal income tax on any unrealized appreciation with respect to our assets to the extent that any such unrealized appreciation is recognized during a specified period up to ten years.

Qualification as a RIC

If we qualify as a RIC and distribute to stockholders each year in a timely manner at least 90.0% of our investment company taxable income, we will not be subject to federal income tax on the portion of our taxable income and gains we distribute to stockholders. We would, however, be subject to a 4.0% nondeductible federal excise tax if we do not distribute, actually or on a deemed basis, an amount at least equal to the sum of (1) 98.0% of our ordinary income for the calendar year, (2) 98.2% of our capital gains in excess of capital losses for the one-year period ending on October 31 of the calendar year and (3) any ordinary income and capital gains in excess of capital losses for preceding years that were not distributed during such years. For the years ended December 31, 2015, 2014 and 2013, we did not incur any excise taxes.

The federal excise tax would apply only to the amount by which the required distributions exceed the amount of income we distribute, actually or on a deemed basis, to stockholders. We will be subject to regular corporate income tax, currently at rates up to 35.0%, on any undistributed income, including both ordinary income and capital gains.

If we acquire debt obligations that (i) were originally issued at a discount, (ii) bear interest at rates that are not either fixed rates or certain qualified variable rates or (iii) are not unconditionally payable at least annually over the life of the obligation, we will be required to include in taxable income each year a portion of the original issue discount (“OID”) that accrues over the life of the obligation. Additionally, PIK interest, which is computed at the contractual rate specified in a loan agreement and is added to the principal balance of a loan, is also a non cash source of income that we are required to include in taxable income each year. Both OID and PIK income will be included in our investment company taxable income even though we receive no cash corresponding to such amounts. As a result, we may be required to make additional distributions corresponding to such OID and PIK amounts in order to satisfy the annual distribution requirement and to continue to qualify as a RIC or to avoid the imposition of federal income and excise taxes. In this event, we may be required to sell investments or other assets to meet the RIC distribution requirements. For the year ended September 30, 2016, we incurred $0.1 million of OID income and the unamortized balance of OID investments (which are primarily all syndicated loans) as of September 30, 2016 totaled $0.5 million. As of September 30, 2016, we had seven investments which had a PIK interest component and we recorded PIK interest income of $2.4 million during the year ended September 30, 2016.

Taxation of Our U.S. Stockholders

Distributions

For any period during which we qualify as a RIC for federal income tax purposes, distributions to our stockholders attributable to our investment company taxable income generally will be taxable as ordinary income to stockholders to the extent of our current or accumulated earnings and profits. We first allocate our earnings and profits to distributions to our preferred stockholders and then to distributions to our common stockholders based on priority in our capital structure. Any distributions in excess of our current and accumulated earnings and profits will first be treated as a return of capital to the extent of the stockholder’s adjusted basis in his or her shares of common stock and thereafter as gain from the sale of shares of our common stock. Distributions of our long-term capital gains, reported by us as such, will be taxable to stockholders as long-term capital gains regardless of the stockholder’s holding period for its common stock and whether the distributions are paid in cash or invested in additional common stock. Corporate stockholders are generally eligible for the 70.0% dividends received deduction with respect to dividends received from us, other than capital gains dividends, but only to the extent such amount is attributable to dividends received by us from taxable domestic corporations. Certain U.S. stockholders who are individuals, estates and trusts generally are subject to a 3.8% Medicare tax on dividends on shares of our stock.

15

Any dividend declared by us in October, November or December of any calendar year, payable to stockholders of record on a specified date in such a month and actually paid during January of the following year, will be treated as if it were paid by us and received by the stockholders on December 31 of the previous year. In addition, we may elect (in accordance with Section 855(a) of the Code) to relate a dividend back to the prior taxable year if we (1) declare such dividend prior to the later of the due date for filing our return for that taxable year or the 15th day of the ninth month following the close of the taxable year, (2) make the election in that return, and (3) distribute the amount in the 12-month period following the close of the taxable year but not later than the first regular dividend payment of the same type following the declaration. Any such election will not alter the general rule that a stockholder will be treated as receiving a dividend in the taxable year in which the distribution is made, subject to the October, November, December rule described above.

If a common stockholder participates in our “opt in” dividend reinvestment plan, any distributions reinvested under the plan will be taxable to the common stockholder to the same extent, and with the same character, as if the common stockholder had received the distribution in cash. The common stockholder will have an adjusted basis in the additional common shares purchased through the plan equal to the amount of the reinvested distribution. The additional shares will have a new holding period commencing on the day following the day on which the shares are credited to the common stockholder’s account. We may use newly issued shares under the guidelines of our dividend reinvestment plan, or we may purchase shares in the open market in connection with the obligations under the plan. We do not have a dividend reinvestment plan for our preferred stockholders.

Sale of Our Shares

A U.S. stockholder generally will recognize taxable gain or loss if the U.S. stockholder sells or otherwise disposes of his, her or its shares of our common or preferred stock. Any gain arising from such sale or disposition generally will be treated as long-term capital gain or loss if the U.S. stockholder has held his, her or its shares for more than one year. Otherwise, it will be classified as short-term capital gain or loss. However, any capital loss arising from the sale or disposition of shares of our common stock held for six months or less will be treated as long-term capital loss to the extent of the amount of capital gain dividends received, or undistributed capital gain deemed received, with respect to such shares. Under the tax laws in effect as of the date of this filing, individual U.S. stockholders are subject to a maximum federal income tax rate of 20.0% on their net capital gain (i.e. the excess of realized net long-term capital gain over realized net short-term capital loss for a taxable year) including any long-term capital gain derived from an investment in our shares. Such rate is lower than the maximum rate on ordinary income currently payable by individuals. Corporate U.S. stockholders currently are subject to federal income tax on net capital gain at the same rates applied to their ordinary income (currently up to a maximum of 35.0%). Capital losses are subject to limitations on use for both corporate and non-corporate stockholders. Certain U.S. stockholders who are individuals, estates or trusts generally are subject to a 3.8% Medicare tax on capital gain from the sale or other disposition of, shares of our common stock.

Backup Withholding or Other Required Withholding

We may be required to withhold federal income tax, or backup withholding, currently at a rate of 28.0%, from all taxable distributions to any non-corporate U.S. stockholder (1) who fails to furnish us with a correct taxpayer identification number or a certificate that such stockholder is exempt from backup withholding, or (2) with respect to whom the Internal Revenue Service (“IRS”) notifies us that such stockholder has failed to properly report certain interest and dividend income to the IRS and to respond to notices to that effect. An individual’s taxpayer identification number is generally his or her social security number. Any amount withheld under backup withholding is allowed as a credit against the U.S. stockholder’s federal income tax liability, provided that proper information is provided to the IRS.

The Foreign Account Tax Compliance Act imposes a federal withholding tax on certain types of payments made to “foreign financial institutions” and certain other non-U.S. entities unless certain due diligence, reporting, withholding, and certification obligation requirements are satisfied. Under delayed effective dates provided for in the Treasury Regulations and other IRS guidance, such required withholding will not begin until January 1, 2019 with respect to gross proceeds from a sale or other disposition of our stock.

Regulation as a BDC

We are a closed-end, non-diversified management investment company that has elected to be regulated as a BDC under Section 54 of the 1940 Act. As such, we are subject to regulation under the 1940 Act. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates, principal underwriters and affiliates of those affiliates or underwriters and requires that a majority of the directors be persons other than “interested persons,” as defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a BDC unless approved by a majority of our outstanding “voting securities,” as defined in the 1940 Act.

16

We intend to conduct our business so as to retain our status as a BDC. A BDC may use capital provided by public stockholders and from other sources to invest in long-term private investments in businesses. A BDC provides stockholders the ability to retain the liquidity of a publicly traded stock while sharing in the possible benefits, if any, of investing in primarily privately owned companies. In general, a BDC must have been organized and have its principal place of business in the U.S. and must be operated for the purpose of making investments in qualifying assets, as described in Sections 55(a)(1) through (a)(3) of the 1940 Act.

Qualifying Assets

Under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets, other than certain interests in furniture, equipment, real estate, or leasehold improvements (“operating assets”) represent at least 70.0% of our total assets, exclusive of operating assets. The types of qualifying assets in which we may invest under the 1940 Act include, but are not limited to, the following:

| (1) | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer is an eligible portfolio company. An eligible portfolio company is generally defined in the 1940 Act as any issuer which: |

| (a) | is organized under the laws of, and has its principal place of business in, any State or States in the U.S.; |

| (b) | is not an investment company (other than a small business investment company wholly owned by the BDC or otherwise excluded from the definition of investment company); and |

| (c) | satisfies one of the following: |

| (i) | it does not have any class of securities with respect to which a broker or dealer may extend margin credit; |

| (ii) | it is controlled by the BDC and for which an affiliate of the BDC serves as a director; |

| (iii) | it has total assets of not more than $4.0 million and capital and surplus of not less than $2 million; |

| (iv) | it does not have any class of securities listed on a national securities exchange; or |

| (v) | it has a class of securities listed on a national securities exchange, with an aggregate market value of outstanding voting and non-voting equity of less than $250.0 million. |

| (2) | Securities received in exchange for or distributed on or with respect to securities described in (1) above, or pursuant to the exercise of options, warrants or rights relating to such securities. |

| (3) | Cash, cash items, government securities or high quality debt securities maturing in one year or less from the time of investment. |

Asset Coverage