Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

for the

fiscal year ended September 30, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

for the

transition period

from

to

Commission

file number 814-00237

GLADSTONE CAPITAL

CORPORATION

(Exact

name of registrant as specified in its charter)

|

Maryland

|

|

54-2040781

|

|

(State or other

jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1521

Westbranch Drive, Suite 200

McLean, Virginia

|

|

22102

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

(703) 287-5800

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.001 par value per share

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. YES o NO x.

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section 15(d) of

the Act. YES o NO x.

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past

90 days. YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to

Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this 10-K

or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company (as defined in Rule 12b-2 of the Exchange Act). See the definitions of “large accelerated filer,” “accelerated

filer,” and “smaller reporting company” in Rule 12 b-2 of the Exchange

Act.

|

Large Accelerated filer o

|

|

Accelerated filer x

|

|

|

|

|

|

Non-Accelerated filer o

|

|

Smaller reporting company o.

|

Indicate by

check mark whether the registrant is a shell company (as defined in Rule 12 b-2

of the Exchange Act). YES o

NO x.

The aggregate market value of the voting stock held by non-affiliates of

the Registrant on March 31, 2009, based on the closing price on that date

of $6.26 on the Nasdaq Global Select Market, was $123,940,569. For the purposes

of calculating this amount only, all directors and executive officers of the

Registrant have been treated as affiliates.

There were 21,087,574 shares of the Registrant’s Common Stock, $0.001

par value, outstanding as of November 23, 2009.

Documents Incorporated by Reference. Portions of the Registrant’s

Proxy Statement relating to the Registrant’s 2010 Annual Meeting of

Stockholders are incorporated by reference into Part III of this Report.

Table of Contents

FORWARD-LOOKING STATEMENTS

All statements contained herein, other than

historical facts, may constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21 of the Securities Act of 1934, as amended (the “Exchange

Act”). These statements may relate to, among other things, future events or our

future performance or financial condition. In some cases, you can identify

forward-looking statements by terminology such as “may,” “might,” “believe,” “will,”

“provided,” “anticipate,” “future,” “could,” “growth,” “plan,” “intend,” “expect,”

“should,” “would,” “if,” “seek,” “possible,” “potential,” “likely” or the

negative of such terms or comparable terminology. These forward-looking

statements involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance or achievements

to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking

statements. Such factors include, among others: (1) further adverse

changes in the economy and the capital markets; (2) risks associated with

negotiation and consummation of pending and future transactions; (3) the

loss of one or more of our executive officers, in particular David Gladstone,

Terry Lee Brubaker, or George Stelljes III; (4) changes in our business

strategy; (5) availability, terms and deployment of capital; (6) changes

in our industry, interest rates, exchange rates or the general economy; (7) the

degree and nature of our competition; and (8) those factors described in

the “Risk Factors” section of this Form 10-K. We caution readers not

to place undue reliance on any such forward-looking statements. We undertake no

obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, after the date of

this Form 10-K.

PART I

(Dollar amounts in thousands, unless otherwise

indicated)

In this Annual Report on Form 10-K, or Annual Report,

the “Company,” “we,” “us,” and “our” refer to Gladstone Capital Corporation and

its wholly-owned subsidiaries unless the context otherwise indicates.

Item 1. Business

Overview

We were incorporated

under the General Corporation Laws of the State of Maryland on May 30,

2001 and completed our initial public offering on August 24, 2001. We

operate as a closed-end, non-diversified management investment company, and we

have elected to be treated as a business development company (“BDC”) under the

Investment Company Act of 1940, as amended ( the “1940 Act”). In addition, for tax purposes we have elected

to be treated as a regulated investment company (“RIC”) under the Internal

Revenue Code of 1986, as amended (the “Code”).

We seek to achieve a high

level of current income by investing in debt securities, consisting primarily

of senior notes, senior subordinated notes and junior subordinated notes, of

established private businesses that are substantially owned by leveraged buyout

funds, or individual investors or are family-owned businesses, with a

particular focus on senior notes. In addition, we may acquire from others

existing loans that meet this profile.

We also seek to provide our stockholders with long-term capital growth

through appreciation in the value of warrants or other equity instruments that

we may receive when we make loans.

We seek to invest in

small and medium-sized private U.S. businesses that meet certain criteria,

including some but not necessarily all of the following: the potential for

growth in cash flow, adequate assets for loan collateral, experienced

management teams with a significant ownership interest in the borrower,

profitable operations based on the borrower’s cash flow, reasonable

capitalization of the borrower (usually by leveraged buyout funds or venture

capital funds) and the potential to realize appreciation and gain liquidity in

our equity positions, if any. We

anticipate that liquidity in our equity position will be achieved through a

merger or acquisition of the borrower, a public offering of the borrower’s

stock or by exercising our right to require the borrower to repurchase our

warrants, though there can be no assurance that we will always have these

rights. We seek to lend to borrowers

that need funds to finance growth, restructure their balance sheets or effect a

change of control.

We seek to invest

primarily in three categories of debt of private companies:

· Senior Notes.

We seek to invest a portion of our assets in senior notes of

borrowers. Using its assets and cash

flow as collateral, the borrower typically uses senior notes to cover a substantial

portion of the funding needed to operate.

Senior

2

Table of Contents

lenders are

exposed to the least risk of all providers of debt because they command a

senior position with respect to scheduled interest and principal payments. However, unlike senior subordinated and

junior subordinated lenders, these senior lenders typically do not receive any

stock, warrants to purchase stock of the borrowers or other yield

enhancements. As such, they generally do

not participate in the equity appreciation of the value of the business. Senior

notes may include revolving lines of credit, senior term loans, senior

syndicated loans and senior last-out tranche loans.

· Senior Subordinated Notes. We seek to invest a portion of our assets in senior

subordinated notes, which include second lien notes. Holders of senior subordinated notes are

subordinated to the rights of holders of senior debt in their right to receive principal

and interest payments or, in the case of last out tranches of senior debt,

liquidation proceeds from the borrower.

As a result, senior subordinated notes are riskier than senior notes. Although such loans are sometimes secured by

significant collateral, the lender is largely dependent on the borrower’s cash

flow for repayment. Additionally,

lenders may receive warrants to acquire shares of stock in borrowers or other

yield enhancements in connection with these loans. Senior subordinated notes include second lien

loans and syndicated second lien loans.

· Junior Subordinated Notes.

We also seek to invest a small portion of our assets in junior

subordinated notes, which include mezzanine notes. Holders of junior subordinated notes are

subordinated to the rights of the holders of senior debt and senior

subordinated debt in their rights to receive principal and interest payments

from the borrower. The risk profile of

junior subordinated notes is high, which permits the junior subordinated lender

to obtain higher interest rates and more equity and equity-like compensation.

Investment

Concentrations

At September 30,

2009, we had aggregate investments in 48 portfolio companies, and approximately

66.1% of the aggregate fair value of such investments was senior term debt,

approximately 33.0% was senior subordinated term debt, no investments were in

junior subordinated debt and approximately 0.9% was in equity securities. The following table outlines our investments

by type at September 30, 2009 and 2008:

|

|

|

September 30, 2009

|

|

September 30, 2008

|

|

|

|

|

Cost

|

|

Fair Value

|

|

Cost

|

|

Fair Value

|

|

|

Senior

Notes

|

|

$

|

240,172

|

|

$

|

212,290

|

|

$

|

297,910

|

|

$

|

265,297

|

|

|

Senior

Subordinated Notes

|

|

118,743

|

|

105,794

|

|

157,927

|

|

140,676

|

|

|

Junior

Subordinated Notes

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Preferred

Equity Securities

|

|

2,028

|

|

—

|

|

1,584

|

|

—

|

|

|

Common

Equity Securities

|

|

3,450

|

|

2,885

|

|

3,449

|

|

1,960

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Investments

|

|

$

|

364,393

|

|

$

|

320,969

|

|

$

|

460,870

|

|

$

|

407,933

|

|

3

Table of

Contents

Investments

at fair value consisted of the following industry classifications as of September 30,

2009 and 2008:

|

|

|

September 30, 2009

|

|

September 30, 2008

|

|

|

|

|

|

|

Percentage

|

|

|

|

Percentage

|

|

|

Industry Classification

|

|

Fair Value

|

|

Total

Investments

|

|

Net

Assets

|

|

Fair Value

|

|

Total

Investments

|

|

Net

Assets

|

|

|

Aerospace &

Defense

|

|

$

|

1,857

|

|

0.6

|

%

|

0.7

|

%

|

$

|

4,192

|

|

1.0

|

%

|

1.6

|

%

|

|

Automobile

|

|

7,999

|

|

2.5

|

%

|

3.2

|

%

|

5,055

|

|

1.2

|

%

|

1.9

|

%

|

|

Broadcast

(TV & Radio)

|

|

43,403

|

|

13.5

|

%

|

17.4

|

%

|

52,336

|

|

12.8

|

%

|

19.2

|

%

|

|

Buildings &

Real Estate

|

|

12,882

|

|

4.0

|

%

|

5.2

|

%

|

13,519

|

|

3.3

|

%

|

5.0

|

%

|

|

Cargo

Transport

|

|

5,427

|

|

1.7

|

%

|

2.2

|

%

|

15,805

|

|

3.9

|

%

|

5.8

|

%

|

|

Chemicals,

Plastics & Rubber

|

|

15,884

|

|

4.9

|

%

|

6.4

|

%

|

16,375

|

|

4.0

|

%

|

6.0

|

%

|

|

Diversified/Conglomerate

Manufacturing

|

|

1,236

|

|

0.4

|

%

|

0.5

|

%

|

3,195

|

|

0.8

|

%

|

1.2

|

%

|

|

Diversified

Natural Resources, Precious Metals & Minerals

|

|

13,589

|

|

4.2

|

%

|

5.5

|

%

|

12,936

|

|

3.2

|

%

|

4.8

|

%

|

|

Electronics

|

|

27,899

|

|

8.7

|

%

|

11.2

|

%

|

35,208

|

|

8.6

|

%

|

13.0

|

%

|

|

Farming &

Agriculture

|

|

9,309

|

|

2.9

|

%

|

3.7

|

%

|

10,031

|

|

2.5

|

%

|

3.7

|

%

|

|

Finance

|

|

—

|

|

—

|

|

—

|

|

1,812

|

|

0.4

|

%

|

0.7

|

%

|

|

Healthcare,

Education & Childcare

|

|

58,054

|

|

18.1

|

%

|

23.3

|

%

|

76,642

|

|

18.8

|

%

|

28.2

|

%

|

|

Home &

Office Furnishings

|

|

16,744

|

|

5.2

|

%

|

6.7

|

%

|

15,379

|

|

3.8

|

%

|

5.7

|

%

|

|

Leisure,

Amusement, Movies & Entertainment

|

|

5,091

|

|

1.6

|

%

|

2.0

|

%

|

8,097

|

|

2.0

|

%

|

3.0

|

%

|

|

Machinery

|

|

9,202

|

|

2.9

|

%

|

3.7

|

%

|

9,834

|

|

2.4

|

%

|

3.6

|

%

|

|

Mining,

Steel, Iron & Non-Precious Metals

|

|

21,926

|

|

6.8

|

%

|

8.8

|

%

|

25,095

|

|

6.2

|

%

|

9.2

|

%

|

|

Personal &

Non-durable Consumer Products

|

|

8,714

|

|

2.7

|

%

|

3.5

|

%

|

9,703

|

|

2.4

|

%

|

3.6

|

%

|

|

Printing &

Publishing

|

|

37,864

|

|

11.8

|

%

|

15.2

|

%

|

60,440

|

|

14.8

|

%

|

22.2

|

%

|

|

Retail

Stores

|

|

23,669

|

|

7.4

|

%

|

9.5

|

%

|

22,800

|

|

5.6

|

%

|

8.4

|

%

|

|

Textiles &

Leather

|

|

220

|

|

0.1

|

%

|

0.1

|

%

|

9,479

|

|

2.3

|

%

|

3.5

|

%

|

|

Total

|

|

$

|

320,969

|

|

100.0

|

%

|

|

|

$

|

407,933

|

|

100.0

|

%

|

|

|

The

investments at fair value were included in the following geographic regions of

the United States at September 30, 2009 and 2008:

|

|

|

September 30, 2009

|

|

September 30, 2008

|

|

|

|

|

|

|

Percentage

|

|

|

|

Percentage

|

|

|

Geographic

Region

|

|

Fair Value

|

|

Total

Investments

|

|

Net

Assets

|

|

Fair Value

|

|

Total

Investments

|

|

Net

Assets

|

|

|

Midwest

|

|

$

|

172,263

|

|

53.7

|

%

|

69.2

|

%

|

$

|

206,271

|

|

50.6

|

%

|

75.9

|

%

|

|

West

|

|

65,678

|

|

20.4

|

%

|

26.4

|

%

|

85,294

|

|

20.9

|

%

|

31.4

|

%

|

|

Southeast

|

|

34,708

|

|

10.8

|

%

|

13.9

|

%

|

49,374

|

|

12.1

|

%

|

18.2

|

%

|

|

Mid-Atlantic

|

|

28,437

|

|

8.9

|

%

|

11.4

|

%

|

50,807

|

|

12.4

|

%

|

18.7

|

%

|

|

Northeast

|

|

14,170

|

|

4.4

|

%

|

5.7

|

%

|

10,617

|

|

2.6

|

%

|

3.9

|

%

|

|

U.S.

Territory

|

|

5,713

|

|

1.8

|

%

|

2.3

|

%

|

5,570

|

|

1.4

|

%

|

2.0

|

%

|

|

|

|

$

|

320,969

|

|

100.0

|

%

|

|

|

$

|

407,933

|

|

100.0

|

%

|

|

|

The

geographic region indicates the location of the headquarters for our portfolio

companies. A portfolio company may have

a number of other business locations in other geographic regions.

Our loans typically range

from $5 million to $20 million, generally mature in no more than seven years

and accrue interest at a fixed or variable rate that exceeds the prime

rate. Because the majority of the loans

in our portfolio consist of term debt of private companies that typically

cannot or will not expend the resources to have their debt securities rated by

a credit rating agency, we expect that most, if not all, of the debt securities

we acquire will be unrated. Accordingly,

we cannot accurately

4

Table of Contents

predict what ratings these

loans might receive if they were in fact rated, and thus cannot determine

whether or not they could be considered “investment grade” quality.

We hold our loan

investment portfolio through our wholly-owned subsidiary, Gladstone Business

Loan, LLC (“Business Loan”).

Our

Investment Adviser and Administrator

Gladstone Management

Corporation (our “Adviser”) is led by a management team which has extensive

experience in our lines of business. Our

Adviser also has a wholly-owned subsidiary, Gladstone Administration, LLC (the “Administrator”)

which employs our chief financial officer, chief compliance officer, internal

counsel, treasurer and their respective staffs.

Excluding our chief financial officer, all of our executive officers are

officers or directors, or both, of our Adviser and our Administrator.

Our Adviser and

Administrator also provide investment advisory and administrative services,

respectively, to our affiliates Gladstone Commercial Corporation (“Gladstone

Commercial”), a publicly traded real estate investment trust; Gladstone

Investment Corporation (“Gladstone Investment”), a publicly traded business

development company; and Gladstone Land Corporation, a private agricultural

real estate company owned by Mr. David Gladstone, our chairman and chief

executive officer. All of our directors and executive officers, with the

exception of our chief financial officer, serve as either directors or

executive officers, or both, of Gladstone Commercial and Gladstone Investment. Our Adviser’s investment committee is

composed of Mr. David Gladstone, Mr. Terry Brubaker, our vice

chairman, chief operating officer and secretary, and Mr. George Stelljes

III, our president and chief investment officer. In the future, our Adviser may provide

investment advisory and administrative services to other funds, both public and

private, of which it is the sponsor.

We have been externally

managed by our Adviser pursuant to a contractual investment advisory

arrangement since October 1, 2004.

Our Adviser was organized as a corporation under the laws of the State

of Delaware on July 2, 2002 and is a registered investment adviser under

the Investment Advisers Act of 1940, as amended. Our Adviser and Administrator are

headquartered in McLean, Virginia, a suburb of Washington, D.C., and our

Adviser also has offices in New York, New Jersey, Illinois, Texas and Georgia.

Our

Investment Strategy

Our strategy is to make

loans at favorable interest rates to small and medium-sized businesses. Our

Adviser uses the loan referral networks of Messrs. Gladstone, Stelljes and

Brubaker and of its managing directors to identify and make senior and

subordinated loans to borrowers that need funds to finance growth, restructure

their balance sheets or effect a change of control. We believe that our

business strategy will enable us to achieve a high level of current income by

investing in debt securities, consisting primarily of senior notes, senior

subordinated notes and junior subordinated notes of established private

businesses that are backed by leveraged buyout funds, venture capital funds or

others. In addition, from time to time we might acquire existing loans that

meet this profile from leveraged buyout funds, venture capital funds and

others. We also seek to provide our stockholders with long-term capital growth

through the appreciation in the value of warrants or other equity instruments

that we might receive when we make loans.

We target small and

medium-sized private businesses that meet certain criteria, including some but

not necessarily all of the following: the potential for growth in cash flow,

adequate assets for loan collateral, experienced management teams with a

significant ownership interest in the borrower, profitable operations based on

the borrower’s cash flow, reasonable capitalization of the borrower (usually by

leveraged buyout funds or venture capital funds) and the potential to realize

appreciation and gain liquidity in our equity position, if any. We may achieve

liquidity in an equity position through a merger or acquisition of the

borrower, a public offering of the borrower’s stock or by exercising our right

to require the borrower to repurchase our warrants, although we cannot assure

you that we will always have these rights.

We can also achieve a similar effect by requiring the borrower to pay us

conditional interest, which we refer to as a success fee, upon the occurrence

of certain events. Success fees are

dependent upon the success of the borrower and the occurrence of a triggering

event, and are paid in lieu of warrants to purchase common stock of the

borrower.

5

Table of Contents

Investment

Process

Overview

of Loan Origination and Approval Process

To originate loans, our

Adviser’s investment professionals use an extensive referral network comprised

primarily of venture capitalists, leveraged buyout fund managers, investment

bankers, attorneys, accountants, commercial bankers and business brokers. Our Adviser’s investment professionals review

informational packages from these and other sources in search of potential

financing opportunities. If a potential

opportunity matches our investment objectives, the investment professionals

will seek an initial screening of the opportunity from our Adviser’s investment

committee which is composed of Mr. Gladstone, Mr. Brubaker and Mr. Stelljes. If the prospective portfolio company passes

this initial screening, the investment professionals conduct a due diligence

investigation and create a detailed profile summarizing the prospective

portfolio company’s historical financial statements, industry and management

team and analyzing its conformity to our general investment criteria. The

investment professionals then present this profile to our Adviser’s investment

committee, which must approve each investment.

Further, each financing is reviewed and approved by the members of our

Board of Directors, a majority of whom are not “interested directors” as defined

in Section 2(a)(19) of the 1940 Act.

Prospective

Portfolio Company Characteristics

We have identified

certain characteristics that we believe are important in identifying and

investing in prospective portfolio companies.

The criteria listed below provide general guideposts for our lending and

investment decisions, although not all of these criteria may be met by each

portfolio company.

· Value-and-Income Orientation and

Positive Cash Flow. Our

investment philosophy places a premium on fundamental analysis from an investor’s

perspective and has a distinct value-and-income orientation. In seeking value,

we focus on companies in which we can invest at relatively low multiples of

earnings before interest, taxes, depreciation and amortization (“EBITDA”), and

that have positive operating cash flow at the time of investment. In seeking

income, we seek to invest in companies that generate relatively high and stable

cash flow to provide some assurance that they will be able to service their

debt and pay any required dividends on preferred stock. Typically, we do not

expect to invest in start-up companies or companies with speculative business plans.

· Experienced Management. We

generally require that our portfolio companies have an experienced management team. We also require the portfolio companies to

have in place proper incentives to induce management to succeed and act in

concert with our interests as investors, including having significant equity or

other interests in the financial performance of their companies.

· Strong Competitive Position in an

Industry. We

seek to invest in target companies that have developed strong market positions

within their respective markets and that we believe are well-positioned to

capitalize on growth opportunities. We seek companies that demonstrate

significant competitive advantages versus their competitors, which we believe

will help to protect their market positions and profitability.

· Exit Strategy. We seek to invest in companies that we

believe will provide a stable stream of cash flow that is sufficient to repay

the loans we make to them and to reinvest in their respective businesses. We

expect that such internally generated cash flow, which will allow our portfolio

companies to pay interest on, and repay the principal of, our investments, will

be a key means by which we exit from our investments over time. In addition, we

also seek to invest in companies whose business models and expected future cash

flows offer attractive possibilities for capital appreciation on any equity

interests we may obtain or retain. These capital appreciation possibilities

include strategic acquisitions by other industry participants or financial

buyers, initial public offerings of common stock, or other capital market

transactions.

· Liquidation Value of Assets. The prospective liquidation value of the

assets, if any, collateralizing loans in which we invest is an important factor

in our investment analysis. We emphasize

both tangible and intangible assets, such as accounts receivable, inventory,

equipment, and real estate and intangible assets, such as intellectual

property, customer lists, networks, databases, although the relative weight we

place on these assets will vary by company and industry.

6

Table of Contents

Extensive

Due Diligence

Our Adviser conducts what

we believe are extensive due diligence investigations of our prospective

portfolio companies and investment opportunities. Our due diligence investigation may begin

with a review of publicly available information, and will generally include

some or all of the following:

· a review of the prospective portfolio

company’s borrower’s historical and projected financial information;

· visits to the prospective portfolio

company’s business site(s);

· interviews with the prospective portfolio

company’s management, employees, customers and vendors;

· review of all loan documents;

· background checks on the prospective

portfolio company’s management team; and

· research on the prospective portfolio

company’s products, services or particular industry.

Upon completion of a due

diligence investigation and a decision to proceed with an investment, our

Adviser’s lending professionals who have primary responsibility for the

investment present the investment opportunity to our Adviser’s investment

committee, which consists of Messrs. Gladstone, Brubaker and Stelljes. The

investment committee determines whether to pursue the potential investment.

Additional due diligence of a potential investment may be conducted on our

behalf by attorneys and independent accountants prior to the closing of the

investment, as well as other outside advisers, as appropriate.

We also rely on the

long-term relationships that our Adviser’s professionals have with venture

capitalists, leveraged buyout fund managers, investment bankers, commercial

bankers and business brokers, and on the extensive direct experiences of our

executive officers and managing directors in providing debt and equity capital

to small and medium-sized private businesses.

Investment

Structure

We typically invest in

senior, senior subordinated and junior subordinated loans. Our loans typically

range from $5 million to $20 million, although the size of our

investments may vary as our capital base changes. Our loans generally mature within seven years

and accrue interest at a variable rate that exceeds the LIBOR and prime

rates. In the past, some of our loans

have had a provision that calls for some portion of the interest payments to be

deferred and added to the principal balance so that the interest is paid,

together with the principal, at maturity. This form of deferred interest is

often called “paid in kind” (“PIK”) interest, and, when earned, we record PIK

interest as interest income and add the PIK interest to the principal balance

of the loans. As of September 30,

2009, two loans in our portfolio contained PIK provisions.

To the extent possible,

our loans generally are collateralized by a security interest in the borrower’s

assets. In senior and subordinated

loans, we do not usually have the first claim on these assets. Interest payments

on loans we make will generally be made monthly or quarterly (except to the

extent of any PIK interest) with amortization of principal generally being

deferred for several years. The principal amount of the loans and any accrued

but unpaid interest will generally become due at maturity at five to seven

years. We seek to make loans that are accompanied by warrants to purchase stock

in the borrowers or other yield enhancement features, such as success fees. Any

warrants that we receive will typically have an exercise price equal to the

fair value of the portfolio company’s common stock at the time of the loan and

entitle us to purchase a modest percentage of the borrower’s stock. Success fees are conditional interest that is

paid if the borrower is successful. The success fee is calculated as additional

interest on the loan and is paid upon the occurrence of certain triggering

events, such as the sale of the borrower.

If the event or events do not occur, no success fee will be paid.

From time to time, a portfolio

company may request additional financing, providing us with additional lending

opportunities. We will consider such requests for additional financing under

the criteria we have established for initial investments and we anticipate that

any debt securities we acquire in a follow-on financing will have

characteristics comparable to those issued in the original financing. In some

situations, our failure, inability or decision not to make a follow-on

investment may be detrimental to the operations or survival of a portfolio

company, and thus may jeopardize our investment in that borrower.

As noted above, we expect

to receive yield enhancements in connection with many of our loans, which may

include warrants to purchase stock or success fees. If a financing is

successful, not only will our debt securities have been repaid with interest,

but we will be in a position to realize a gain on the accompanying equity

interests or other yield enhancements. The opportunity to realize such gain may

occur if the borrower is sold to new owners or if it makes a public offering of

its stock. In most cases, we will not have the right to require that a borrower

undergo an initial public offering by registering securities under the

Securities Act of 1933, as amended, (the “Securities Act”), but we generally

will have the right to sell our equity

7

Table of Contents

interests in any

subsequent public offering by the borrower. Even when we have the right to

participate in a borrower’s public offering, the underwriters might insist,

particularly if we own a large amount of equity securities, that we retain all

or a substantial portion of our shares for a specified period of time.

Moreover, we may decide not to sell an equity position even when we have the

right and the opportunity to do so. Thus, although we expect to dispose of an

equity interest after a certain time, situations may arise in which we hold

equity securities for a longer period.

Risk

Management

We seek to limit the

downside risk of our investments by:

· making investments with an expected total

return (including both interest and potential equity appreciation) that we

believe compensates us for the credit risk of the investment;

· seeking collateral or superior positions

in the portfolio company’s capital structure where possible;

· incorporating put rights and call

protection into the investment structure where possible; and

· negotiating covenants in connection with

our investments that afford our portfolio companies as much flexibility as

possible in managing their businesses, consistent with the preservation of our

capital.

Temporary

Investments

Pending investment in

private companies, we invest our otherwise uninvested cash primarily in cash,

cash items, government securities or high-quality debt securities maturing in

one year or less from the time of investment, to which we refer collectively as

temporary investments, so that 70% of our assets are “qualifying assets” for

purposes of the business development company provisions of the 1940 Act. For

information regarding regulations to which we are subject and the definition of

“qualifying assets,” see “ — Regulation as a Business Development Company —

Qualifying Assets.”

Hedging

Strategies

Although it has not yet

happened, nor do we expect this to happen in the near future, when one of our

portfolio companies goes public, we may undertake hedging strategies with

regard to any equity interests that we may have in that company. We may

mitigate risks associated with the volatility of publicly traded securities by,

for instance, selling securities short or writing or buying call or put

options. Hedging against a decline in the value of such investments in public

companies would not eliminate fluctuations in the values of such investments or

prevent losses if the values of such investments decline, but would establish

other investments designed to gain from those same developments. Therefore, by

engaging in hedging transactions, we can moderate the decline in the value of

our hedged investments in public companies. However, such hedging transactions

would also limit our opportunity to gain from an increase in the value of our

investment in the public company.

Hedging strategies can pose risks to us and our stockholders, however we

believe that such activities are manageable because they will be limited to

only a portion of our portfolio.

Section 12(a)(3) of

the 1940 Act prohibits us from effecting a short sale of any security “in

contravention of such rules and regulations or orders as the [SEC] may

prescribe as necessary or appropriate in the public interest or for the

protection of investors . . .” However, to date, the SEC has not promulgated

regulations under this statute. It is possible that such regulations could be

promulgated in the future in a way that would require us to change any hedging

strategies that we may adopt. In

addition, our ability to engage in short sales may be limited by the 1940 Act’s

leverage limitations. We will only

engage in hedging activities in compliance with applicable laws and

regulations.

Competitive

Advantages

A large number of

entities compete with us and make the types of investments that we seek to make

in small and medium-sized privately-owned businesses. Such competitors include

private equity funds, leveraged buyout funds, venture capital funds, investment

banks and other equity and non-equity based investment funds, and other

financing sources, including traditional financial services companies such as

commercial banks. Many of our competitors are substantially larger than we are

and have considerably greater funding sources that are not available to us. In

addition, certain of our competitors may have higher risk tolerances or

different risk assessments, which could allow them to consider a wider variety

of investments, establish more relationships and build their market shares.

Furthermore, many of these competitors are not subject to the

8

Table of Contents

regulatory restrictions

that the 1940 Act imposes on us as a business development company. However, we believe that we have the

following competitive advantages over other providers of financing to small and

mid-sized businesses.

Management

Expertise

David Gladstone, our

chairman and chief executive officer, is also the chairman and chief executive

officer of our Adviser and its affiliated companies, which we refer to as the

Gladstone Companies, and has been involved in all aspects of the Gladstone

Companies’ investment activities, including serving as a member of our Adviser’s

investment committee. Terry Lee Brubaker is our vice chairman, chief operating

officer and secretary, and has substantial experience in acquisitions and

operations of companies. George Stelljes III is our president and chief

investment officer and has extensive experience in leveraged finance. Messrs. Gladstone,

Brubaker and Stelljes have principal management responsibility for our Adviser

as its senior executive officers. These individuals dedicate a significant

portion of their time to managing our investment portfolio. Our senior

management has extensive experience providing capital to small and mid-sized

companies and has worked together for more than 10 years. In addition, we have

access to the resources and expertise of our Adviser’s investment professionals

and supporting staff who possess a broad range of transactional, financial,

managerial and investment skills.

Increased

Access to Investment Opportunities Developed Through Proprietary Research

Capability and an Extensive Network of Contacts

Our Adviser seeks to

identify potential investments both through active origination and due

diligence and through its dialogue with numerous management teams, members of

the financial community and potential corporate partners with whom our Adviser’s

investment professionals have long-term relationships. We believe that our

Adviser’s investment professionals have developed a broad network of contacts

within the investment, commercial banking, private equity and investment

management communities, and that their reputation in investment management enables

us to identify well-positioned prospective portfolio companies which provide

attractive investment opportunities. Additionally, our Adviser expects to

generate information from its professionals’ network of accountants,

consultants, lawyers and management teams of portfolio companies and other

companies.

Disciplined,

Value and Income-Oriented Investment Philosophy with a Focus on Preservation of

Capital

In making its investment

decisions, our Adviser focuses on the risk and reward profile of each prospective

portfolio company, seeking to minimize the risk of capital loss without

foregoing the potential for capital appreciation. We expect our Adviser to use

the same value and income-oriented investment philosophy that its professionals

use in the management of the other Gladstone Companies and to commit resources

to management of downside exposure. Our Adviser’s approach seeks to reduce our

risk in investments by using some or all of the following approaches:

· focusing on companies with good market positions,

established management teams and good cash flow;

· investing in businesses with experienced

management teams;

· engaging in extensive due diligence from

the perspective of a long-term investor;

· investing at low price-to-cash flow

multiples; or

· adopting flexible transaction structures

by drawing on the experience of the investment professionals of our Adviser and

its affiliates.

Longer

Investment Horizon with Attractive Publicly Traded Model

Unlike private equity and

venture capital funds that are typically organized as finite-life partnerships,

we are not subject to standard periodic capital return requirements. The

partnership agreements of most private equity and venture capital funds

typically provide that these funds may only invest investors’ capital once and

must return all capital and realized gains to investors within a finite time

period, often seven to ten years. These provisions often force private equity

and venture capital funds to seek returns on their investments by causing their

portfolio companies to pursue mergers, public equity offerings, or other

liquidity events more quickly than might otherwise be optimal or desirable,

potentially resulting in both a lower overall return to investors and an

adverse impact on their portfolio companies. We believe that our flexibility to

make investments with a long-term view and without the capital return

requirements of traditional private investment vehicles provides us with the

opportunity to achieve greater long-term returns on invested capital.

9

Table of Contents

Flexible

Transaction Structuring

We believe our management

team’s broad expertise and its ability to draw upon many years of combined

experience enables our Adviser to identify, assess, and structure investments

successfully across all levels of a company’s capital structure and manage

potential risk and return at all stages of the economic cycle. We are not

subject to many of the regulatory limitations that govern traditional lending

institutions such as banks. As a result, we are flexible in selecting and

structuring investments, adjusting investment criteria and transaction

structures, and, in some cases, the types of securities in which we invest. We

believe that this approach enables our Adviser to identify attractive

investment opportunities that will continue to generate current income and

capital gain potential throughout the economic cycle, including during

turbulent periods in the capital markets. One example of our flexibility is our

ability to exchange our publicly-traded stock for the stock of an acquisition

target in a tax-free reorganization under the Code. After completing an

acquisition in such an exchange, we can restructure the capital of the small

company to include senior and subordinated debt.

Leverage

For the purpose of making

investments other than temporary investments and to take advantage of favorable

interest rates, we intend to issue senior debt securities (including borrowings

under our current line of credit) up to the maximum amount permitted by the

1940 Act. The 1940 Act currently permits us to issue senior debt securities and

preferred stock, to which we refer collectively as senior securities, in

amounts such that our asset coverage, as defined in the 1940 Act, is at least

200% after each issuance of senior securities. We may also incur such

indebtedness to repurchase our common stock. As a result of issuing senior

securities, we are exposed to the risks of leverage. Although borrowing money

for investments increases the potential for gain, it also increases the risk of

a loss. A decrease in the value of our investments will have a greater impact

on the value of our common stock to the extent that we have borrowed money to

make investments. There is a possibility that the costs of borrowing could

exceed the income we receive on the investments we make with such borrowed

funds. In addition, our ability to pay dividends or incur additional

indebtedness would be restricted if asset coverage is less than twice our

indebtedness. If the value of our assets declines, we might be unable to

satisfy that test. If this happens, we may be required to liquidate a portion

of our loan portfolio and repay a portion of our indebtedness at a time when a

sale may be disadvantageous. Furthermore, any amounts that we use to service

our indebtedness will not be available for distributions to our stockholders.

Our Board of Directors is authorized to provide for the issuance of preferred

stock with such preferences, powers, rights and privileges as it deems

appropriate, provided that such an issuance adheres to the requirements of the

1940 Act. See “Regulation as a Business

Development Company—Asset Coverage” for a discussion of our leveraging

constraints.

Ongoing

Relationships with and Monitoring of Portfolio Companies

Monitoring

Our Adviser’s investment

professionals, led by Terry Lee Brubaker, our chief operating officer, monitor

the financial trends of each portfolio company on an ongoing basis to determine

if each is meeting its respective business plans and to assess the appropriate

course of action for each company. We

monitor the status and performance of each portfolio company and use it to evaluate

the overall performance of our portfolio.

Our Adviser employs

various methods of evaluating and monitoring the performance of each of our

portfolio companies, which include some or all of following:

· assessment of success in the portfolio

company’s overall adherence to its business plan and compliance with covenants;

· attendance at and participation in

meetings of the portfolio company’s board of directors;

· periodic contact, including formal update

interviews with portfolio company management, and, if appropriate, the

financial or strategic sponsor;

· comparison with other companies in the

portfolio company’s industry; and

· review of monthly and quarterly financial

statements and financial projections for portfolio companies.

Managerial

Assistance and Services

As a business development

company, we make available significant managerial assistance to our portfolio

companies and provide other services to such portfolio companies. Neither we

nor our Adviser currently receives fees in connection with managerial

assistance. Our Adviser provides other services to our portfolio companies and

receives fees for these other services, certain of which are credited by 50%

against the investment advisory fees that we pay our Adviser.

10

Table of Contents

Valuation

Process

The following is a

general description of the steps we take each quarter to determine the value of

our investment portfolio. We value our investments in accordance with the

requirements of the 1940 Act. We value securities for which market quotations

are readily available at their market value. We value all other securities and

assets at fair value as determined in good faith by our Board of Directors. In

determining the value of our investments, our Adviser has established an

investment valuation policy (the “Policy”). The Policy has been approved by our

Board of Directors and each quarter the Board of Directors reviews whether our

Adviser has applied the Policy consistently and votes whether or not to accept

the recommended valuation of our investment portfolio. Due to the uncertainty

inherent in the valuation process, such estimates of fair value may differ

significantly from the values that would have been obtained had a ready market

for the securities existed. Investments for which market quotations are readily

available are recorded in our financial statements at such market quotations.

With respect to any investments for which market quotations are not readily

available, we perform the following valuation process each quarter:

· Our

quarterly valuation process begins with each portfolio company or investment

being initially assessed by our Adviser’s investment professionals responsible

for the investment, using the Policy.

· Preliminary

valuation conclusions are then discussed with our management, and documented,

along with any independent opinions of value provided by Standard &

Poor’s Securities Evaluations, Inc. (“SPSE”), for review by our Board of

Directors.

· Our

Board of Directors reviews this documentation and discusses the input of our

Adviser, management, and the opinions of value of SPSE to arrive at a

determination for the aggregate fair value of our portfolio of investments.

Our valuation policies,

procedures and processes are more fully described under “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations — Critical Accounting Policies — Investment Valuation.”

Investment

Advisory and Management Agreements

We are externally managed

pursuant to contractual arrangements with our Adviser and Administrator, under

which our Adviser and Administrator employ all of our personnel and pay our

payroll, benefits, and general expenses directly. On October 1, 2006, we entered into an

amended and restated investment advisory agreement with our Adviser (the “Advisory

Agreement”) and an administration agreement with our Administrator (the “Administration

Agreement”). On July 8, 2009, our

Board of Directors renewed the Advisory Agreement and the Administration

Agreement through August 31, 2010.

The management services and fees in effect under the Advisory Agreement

are described below. In addition to the

fees described below, certain fees received by our Adviser from our portfolio

companies were 100% credited, prior to April 1, 2007, or 50% credited

effective April 1, 2007, against the investment advisory fee. In addition, we pay our direct expenses

including, but not limited to, directors’ fees, legal and accounting fees and

stockholder related expenses under the Advisory Agreement.

Management

services and fees under the Advisory Agreement

Under the Advisory

Agreement, we pay our Adviser an annual base management fee of 2% of our

average gross assets, which is defined as total assets, including investments

made with proceeds of borrowings, less any uninvested cash or cash equivalents

resulting from borrowings, valued at the end of the two most recently completed

calendar quarters, and appropriately adjusted for any share issuances or

repurchases during the current calendar quarter.

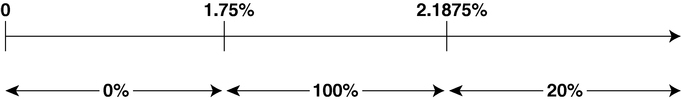

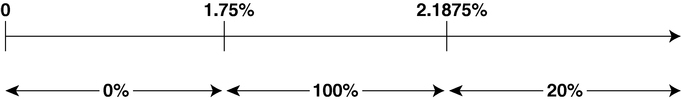

We also pay our Adviser a

two-part incentive fee under the Advisory Agreement. The first part of the incentive fee is an

income-based incentive fee which rewards our Adviser if our quarterly net

investment income (before giving effect to any incentive fee) exceeds 1.75% of

our net assets (the “hurdle rate”). We pay our Adviser an income-based

incentive fee with respect to our pre-incentive fee net investment income in

each calendar quarter as follows:

· no incentive fee in any calendar quarter

in which our pre-incentive fee net investment income does not exceed the hurdle

rate (7% annualized);

· 100% of our pre-incentive fee net

investment income with respect to that portion of such pre-incentive fee net

investment income, if any, that exceeds the hurdle rate but is less than

2.1875% in any calendar quarter (8.75% annualized); and

11

Table of Contents

· 20% of the amount of our pre-incentive

fee net investment income, if any, that exceeds 2.1875% in any calendar quarter

(8.75% annualized).

Quarterly Incentive Fee Based on Net

Investment Income

Pre-incentive fee net investment

income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net

investment income

allocated to income-related portion of incentive fee

The second part of the

incentive fee is a capital gains-based incentive fee that is determined and

payable in arrears as of the end of each fiscal year (or upon termination of

the Advisory Agreement, as of the termination date), equals 20% of our realized

capital gains as of the end of the fiscal year.

In determining the capital gains-based incentive fee payable to our

Adviser, we calculate the cumulative aggregate realized capital gains and

cumulative aggregate realized capital losses since our inception, and the

aggregate unrealized capital depreciation as of the date of the calculation, as

applicable, with respect to each of the investments in our portfolio. For this

purpose, cumulative aggregate realized capital gains, if any, equals the sum of

the differences between the net sales price of each investment, when sold, and

the original cost of such investment since our inception. Cumulative aggregate

realized capital losses equals the sum of the amounts by which the net sales

price of each investment, when sold, is less than the original cost of such

investment since our inception. Aggregate unrealized capital depreciation

equals the sum of the difference, if negative, between the valuation of each

investment as of the applicable calculation date and the original cost of such

investment. At the end of the applicable year, the amount of capital gains that

serves as the basis for our calculation of the capital gains-based incentive

fee equals the cumulative aggregate realized capital gains less cumulative

aggregate realized capital losses, less aggregate unrealized capital

depreciation, with respect to our portfolio of investments. If this number is

positive at the end of such year, then the capital gains-based incentive fee

for such year equals 20% of such amount, less the aggregate amount of any

capital gains-based incentive fees paid in respect of our portfolio in all

prior years.

Beginning in April 2006,

our Board of Directors has accepted from the Adviser unconditional and

irrevocable voluntary waivers on a quarterly basis to reduce the annual 2% base

management fee on senior syndicated loan participations to 0.5%, to the extent

that proceeds resulting from borrowings were used to purchase such syndicated

loan participations. These waivers were applied through September 30,

2009, and any waived fees may not be recouped by our Adviser in the future.

When our Adviser receives

fees from our portfolio companies, such as investment banking fees, structuring

fees or executive recruiting services fees, 50% of certain of these fees are

credited against the base management fee that we would otherwise be required to

pay to our Adviser.

In addition, our Adviser

services the loans held by Business Loan in return for which our Adviser

receives a 1.5% annual fee based on the monthly aggregate outstanding loan

balance of the loans pledged under our credit facility. This fee directly reduces the amount of the

fee payable under the Advisory Agreement. Loan servicing fees of $5,620 were

incurred for the fiscal year ended September 30, 2009, all of which were

directly credited against the amount of the base management fee due to our

Adviser under the Advisory Agreement.

We pay our direct

expenses including, but not limited to, directors’ fees, legal and accounting

fees, stockholder-related expenses, and directors and officers insurance under

the Advisory Agreement.

12

Table of Contents

Administration

Agreement

Under the Administration

Agreement, we pay separately for administrative services. The Administration

Agreement provides for payments equal to our allocable portion of the

Administrator’s overhead expenses in performing its obligations under the

Administration Agreement including, but not limited to, rent for employees of

the Administrator and our allocable portion of the salaries and benefits

expenses of our chief financial officer, chief compliance officer, internal

counsel, treasurer and their respective staffs.

Our allocable portion of expenses is derived by multiplying our

Administrator’s total expenses by the percentage of our average total assets

(the total assets at the beginning and end of each quarter) in comparison to

the average total assets of all companies managed by our Adviser under similar

agreements.

Material

U.S. Federal Income Tax Considerations

Regulated

Investment Company Status

In order to maintain the

qualification for treatment as a RIC under Subchapter M of the Code, we must

distribute to our stockholders, for each taxable year, at least 90% of our

investment company taxable income, which is generally our ordinary income plus

short-term capital gains. We refer to this as the annual distribution

requirement. We must also meet several additional requirements, including:

· Income source requirements. At least 90% of our gross income for

each taxable year must be from dividends, interest, payments with respect to

securities loans, gains from sales or other dispositions of securities or other

income derived with respect to our business of investing in securities, and net

income derived from an interest in a qualified publicly traded partnership.

· Asset diversification

requirements. As

of the close of each quarter of our taxable year: (1) at least 50% of the

value of our assets must consist of cash, cash items, U.S. government

securities, the securities of other regulated investment companies and other

securities to the extent that (a) we do not hold more than 10% of the

outstanding voting securities of an issuer of such other securities and (b) such

other securities of any one issuer do not represent more than 5% of our total

assets, and (2) no more than 25% of the value of our total assets may be

invested in the securities of one issuer (other than U.S. government securities

or the securities of other regulated investment companies), or of two or more

issuers that are controlled by us and are engaged in the same or similar or

related trades or businesses or in the securities of one or more qualified

publicly traded partnerships.

Failure

to Qualify as a RIC. If we are unable to qualify for treatment

as a RIC, we will be subject to tax on all of our taxable income at regular

corporate rates. We would not be able to deduct distributions to stockholders,

nor would we be required to make such distributions. Distributions would be

taxable to our stockholders as ordinary dividend income to the extent of our

current and accumulated earnings and profits. Subject to certain limitations

under the Code, corporate distributees would be eligible for the dividends

received deduction. Distributions in excess of our current and accumulated

earnings and profits would be treated first as a return of capital to the

extent of the stockholder’s tax basis, and then as a gain realized from the

sale or exchange of property. If we fail to meet the RIC requirements for more

than two consecutive years and then seek to requalify as a RIC, we would be

required to recognize a gain to the extent of any unrealized appreciation on

our assets unless we make a special election to pay corporate-level tax on any

such unrealized appreciation recognized during the succeeding 10-year period.

Absent such special election, any gain we recognized would be deemed

distributed to our stockholders as a taxable distribution.

Qualification

as a RIC. If we qualify as a RIC and distribute to

stockholders each year in a timely manner at least 90% of our investment

company taxable income, we will not be subject to federal income tax on the

portion of our taxable income and gains we distribute to stockholders. We

would, however, be subject to a 4% nondeductible federal excise tax if we do

not distribute, actually or on a deemed basis, 98% of our income, including

both ordinary income and capital gains. The excise tax would apply only to the

amount by which 98% of our income exceeds the amount of income we distribute,

actually or on a deemed basis, to stockholders.

We will be subject to regular corporate income tax, currently at rates

up to 35%, on any undistributed income, including both ordinary income and

capital gains. We intend to retain some or all of our capital gains, but to

designate the retained amount as a deemed distribution. In that case, among

other consequences, we will pay tax on the retained amount, each stockholder will

be required to include its share of the deemed distribution in income as if it

had been actually distributed to the stockholder and the stockholder will be

entitled to claim a credit or refund equal to its allocable share of the tax we

pay on the retained capital gain. The amount of the deemed distribution net of

such tax will be added to the stockholder’s cost basis for its common stock.

Since we expect to pay tax on any retained capital gains at our regular

13

Table of Contents

corporate capital gain

tax rate, and since that rate is in excess of the maximum rate currently

payable by individuals on long-term capital gains, the amount of tax that

individual stockholders will be treated as having paid will exceed the tax they

owe on the capital gain dividend and such excess may be claimed as a credit or

refund against the stockholder’s other tax obligations. A stockholder that is

not subject to U.S. federal income tax or tax on long-term capital gains would

be required to file a U.S. federal income tax return on the appropriate

form in order to claim a refund for the taxes we paid. In order to utilize the

deemed distribution approach, we must provide written notice to the

stockholders prior to the expiration of 60 days after the close of the

relevant tax year. We will also be subject to alternative minimum tax, but any

tax preference items would be apportioned between us and our stockholders in

the same proportion that dividends, other than capital gain dividends, paid to

each stockholder bear to our taxable income determined without regard to the

dividends paid deduction.

If we acquire debt

obligations that were originally issued at a discount, which would generally

include loans we make that are accompanied by warrants, that bear interest at

rates that are not either fixed rates or certain qualified variable rates or

that are not unconditionally payable at least annually over the life of the

obligation, we will be required to include in taxable income each year a

portion of the original issue discount (“OID”) that accrues over the life of

the obligation. Such OID will be included in our investment company taxable

income even though we receive no cash corresponding to such discount amount. As

a result, we may be required to make additional distributions corresponding to

such OID amounts in order to satisfy the annual distribution requirement and to

continue to qualify as a RIC or to avoid the 4% excise tax. In this event, we

may be required to sell temporary investments or other assets to meet the RIC

distribution requirements. Through September 30,

2009, we incurred no OID income.

Taxation

of Our U.S. Stockholders

Distributions. For any period during which we qualify for treatment

as a RIC for federal income tax purposes, distributions to our stockholders

attributable to our investment company taxable income generally will be taxable

as ordinary income to stockholders to the extent of our current or accumulated

earnings and profits. Any distributions in excess of our earnings and profits

will first be treated as a return of capital to the extent of the stockholder’s

adjusted basis in his or her shares of common stock and thereafter as gain from

the sale of shares of our common stock. Distributions of our long-term capital

gains, designated by us as such, will be taxable to stockholders as long-term

capital gains regardless of the stockholder’s holding period for its common

stock and whether the distributions are paid in cash or invested in additional

common stock. Corporate stockholders are generally eligible for the 70%

dividends received deduction with respect to ordinary income, but not to

capital gains dividends to the extent such amount designated by us does not

exceed the dividends received by us from domestic corporations. Any dividend

declared by us in October, November or December of any calendar year,

payable to stockholders of record on a specified date in such a month and actually

paid during January of the following year, will be treated as if it were

paid by us and received by the stockholders on December 31 of the previous

year. In addition, we may elect to relate a dividend back to the prior taxable

year if we (1) declare such dividend prior to the due date for filing our

return for that taxable year, (2) make the election in that return, and (3) distribute

the amount in the 12-month period following the close of the taxable year but

not later than the first regular dividend payment following the declaration.

Any such election will not alter the general rule that a stockholder will

be treated as receiving a dividend in the taxable year in which the

distribution is made, subject to the October, November, December rule described

above.

In general, the tax rates

applicable to our dividends other than dividends designated as capital gain

dividends will be the standard ordinary income tax rates, and not the lower

federal income tax rate applicable to “qualified dividend income.” If we

distribute dividends that are attributable to actual dividend income received

by us that is eligible to be, and is, designated by us as qualified dividend

income, such dividends would be eligible for such lower federal income tax

rate. For this purpose, “qualified dividend income” means dividends received by

us from United States corporations and qualifying foreign corporations,

provided that both we and the stockholder recipient of our dividend satisfy

certain holding period and other requirements in respect of our shares (in the

case of our stockholder) and the stock of such corporations (in our case).

However, we do not anticipate receiving or distributing a significant amount of

qualified dividend income.

If a stockholder

participates in our dividend reinvestment plan, any distributions reinvested

under the plan will be taxable to the stockholder to the same extent, and with

the same character, as if the stockholder had received the distribution in

cash. The stockholder will have an adjusted basis in the additional common

shares purchased through the plan equal to the amount of the reinvested

distribution. The additional shares will have a new holding period commencing

on the day following the day on which the shares are credited to the

stockholder’s account.

Sale of

Our Shares. A U.S. stockholder generally will recognize taxable gain or loss

if the U.S. stockholder sells or otherwise disposes of his, her or its

shares of our common stock. Any gain arising from such sale or disposition

generally will

14

Table of Contents

be treated as long-term

capital gain or loss if the U.S. stockholder has held his, her or its

shares for more than one year. Otherwise, it will be classified as short-term

capital gain or loss. However, any capital loss arising from the sale or

disposition of shares of our common stock held for six months or less will be

treated as long-term capital loss to the extent of the amount of capital gain

dividends received, or undistributed capital gain deemed received, with respect

to such shares. Under the tax laws in

effect as of the date of this filing, individual U.S. stockholders are

subject to a maximum federal income tax rate of 15% on their net capital gain ( i.e. the excess of realized net

long-term capital gain over realized net short-term capital loss for a taxable

year) including any long-term capital gain derived from an investment in our

shares. Such rate is lower than the maximum rate on ordinary income currently

payable by individuals. Corporate U.S. stockholders currently are subject

to federal income tax on net capital gain at the same rates applied to their

ordinary income (currently up to a maximum of 35%). Capital losses are subject

to limitations on use for both corporate and non-corporate stockholders.

Backup

Withholding. We may be required to withhold federal income tax, or backup

withholding, currently at a rate of 28%, from all taxable distributions to any

non-corporate U.S. stockholder (1) who fails to furnish us with a

correct taxpayer identification number or a certificate that such stockholder

is exempt from backup withholding, or (2) with respect to whom the

Internal Revenue Service (“IRS”) notifies us that such stockholder has failed

to properly report certain interest and dividend income to the IRS and to

respond to notices to that effect. An individual’s taxpayer identification

number is generally his or her social security number. Any amount withheld

under backup withholding is allowed as a credit against the

U.S. stockholder’s federal income tax liability, provided that proper

information is provided to the IRS.

Regulation

as a Business Development Company

We are a closed-end,

non-diversified management investment company that has elected to be regulated

as a business development company under Section 54 of the 1940 Act. As

such, we are subject to regulation under the 1940 Act. The 1940 Act contains

prohibitions and restrictions relating to transactions between business

development companies and their affiliates, principal underwriters and

affiliates of those affiliates or underwriters and requires that a majority of